Example of Pastors W-2

Example of Pastors W-2 Forms:

As I stated on my

"Ministers: Employee or Not"

page, most of the time a pastor/minister is considered an employee of

their church and should be issued a W-2 to report their compensation.

How to fill out a Minister’s W-2 Form

Payroll is something you want to get right as it affects your employees and legal situation.

See a step by step payroll guide for more information on setting up a proper payroll for your Pastor and employees.

One of the most important factors to keep in mind while setting up a payroll for a church is that your minister's payroll is handled differently than your nonminister employees.

See this page on clergy tax to learn how to properly handle a minister's pay.

See this page for how to handle your nonminister employee payroll taxes.

See the example of a pastors W-2 below for tips on handling a pastor's pay, housing allowance, and even business expenses.

Coupon!

Here is a 10% discount code for all the ebooks, spreadsheets, and packages on this site:

FCA

Note: click on "PACKAGES" in the top navigation bar for a list of all of the ebook and spreadsheet packages on this site!

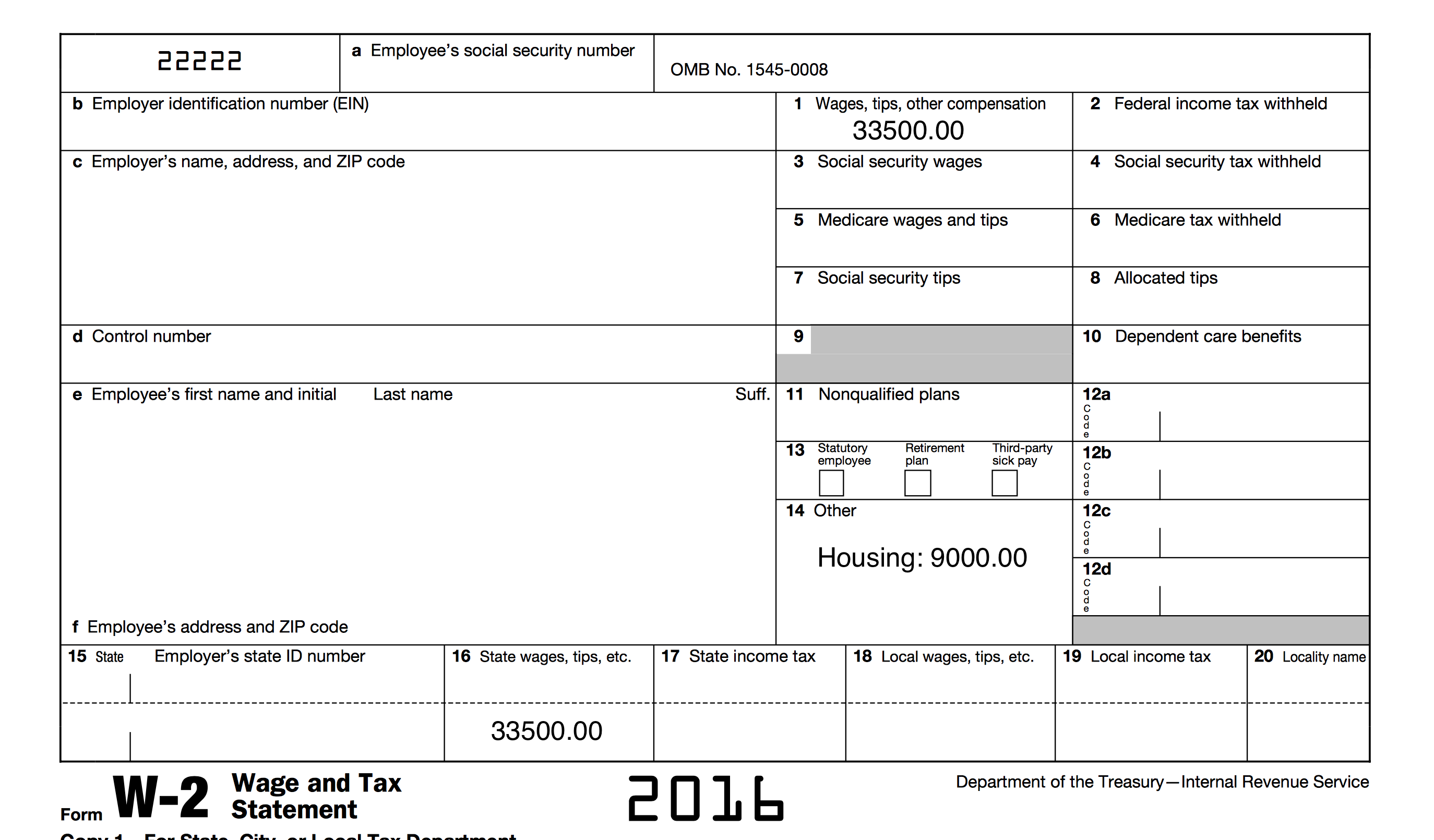

Example of Pastors W-2:

Pastor Smith has a base salary of $25,000. (NOTE: His base salary does not include his housing allowance!)

He is also received $9,000 for his housing allowance in addition to his salary.

(His housing allowance was properly set up with an adopted resolution before it was paid.)

Pastor Smith also has a non-accountable car allowance of $2,500. The church has set up an accountable reimbursement policy and Pastor Smith has been paid $1500 for appropriate business expenses.

Pastor Smith has not requested any voluntary federal income tax withholding by the church. He makes quarterly estimated tax payments . The church gives him a social security tax allowance of $500 a month to help with his self-employment tax.

So the TOTAL amount paid to Pastor Smith for the year is: $44,000

Breakdown of that amount:

$25,000 base salary

$9,000 housing allowance

$2,500 car allowance (he is not turning in mileage logs and paid a set amount, so allowance is taxable income)

$6000 SECA Allowance (a church can pay such an allowance, but it is taxable income)

$1500 (accountable reimbursement business expenses)

The Policies and Procedures Package includes an ebook on Receipts and Reimbursements that explores the management of receipts and supporting documents.

Additionally, it provides insights on establishing and managing an efficient accountable reimbursement policy.

Includes a sample of a resolution you can use to present to the board to set up and approve an accountable reimbursement plan.

.

This ebook is included in the Policies and Procedures Package. However, you can purchase it by itself for only $7.95 by clicking the ADD TO CART button below!

The Receipts and Reimbursements ebook is also part of a larger "Policies and Procedures" Package" that is packed full of valuable information and for a limited time you can purchase all 5 ebooks and 8 policy templates for only $32.80

Example of pastor's W-2 instructions:

- Fill out the information boxes a, b, c, e, and f.

- Include his base salary of $25,000, his unaccountable car allowance of $2,500, and the $6,000 social security tax allowance in Box 1. $33,500.00. Note that we did not include the tax-free amount of $1,500 (accountable reimbursements) It would not be reported anywhere on the W-2.

- Leave boxes: 2, 3, 4, 5, 6, 7, 8, 9, 10, 11, 12, and 13 blank. Do not insert 0s.

- Put the housing allowance in Box 14: Housing: 9000.00 [Optional...could also just include the amount of the allowance in a separate letter to the minister. (This separate letter should not be sent to the IRS and will not be included or attached to the minister's personal tax return.)]

- Complete boxes 16-20 according to your state’s requirements.

The Compensating Ministers Package includes three ebooks on how to compensate and pay your ministers; what minister benefits could potentially hurt the minister and the church; how to set up a housing allowance and report it; and how to handle ministers' gifts/love offerings. Also includes an example of a W-2 for a minister.

Additionally there is a sample of a resolution you can use to to set up and approve a housing allowance for your ministers; an estimate worksheet for the minister to use to help the church determine the amount of the housing allowance; and an example of a notification letter the church can use to inform the minister on the amount of housing allowance payments paid during a calendar year.

All 3 ebooks are only $18.55 PLUS you can use the discount code: FCA for an additional 10% off!

Comments...

Enter your title of your tip, idea, comment, or question in the text box below.

Keep the title as short as possible, but interesting enough to make people want to click on your title.

Then click on the link below it that says: Click here to see the rest of the form and complete your submission.

Write your post. Elaborate and give all the details necessary to properly convey your meaning or question,

Please be aware that with my bookkeeping company, building and maintaining websites, and my volunteer work at my church, I cannot possibly answer and comment on every submission.

However, your opinions, questions, and comments are very valuable to me...so I will try to answer questions when I can, but I am relying on the goodness of others to help here:)

Important! Comments used to go live without my approval. I would have liked to keep it this way, but there are some that take advantage of that. As a result of their blatant disregard of my request to stop posting their spam on this site... I now must approve comments first. I apologize for this inconvenience and will post your comments asap.

Questions and Comments on Ministers' W-2s

Do you have a question or comment about a minister or pastor's W-2? Share it!

Archive of Minister W-2 Questions (& Answers)

The following comments, tips, and Q/A were provided by FreeChurchAccounting's generous readers:

Pastor housing stipend reporting

We are a small church and pay our pastor a housing stipend monthly. We've been taxing this payment. How do we report on the W2?

How do clergy voluntary retirement payroll deductions and matching contribution by the church impact W-2s?

I understand W-2 line 1 wages exclude voluntary retirement deductions, but does the church matching contribution go unreported on the W-2 since it is sent …

W2's and filling out all income

We are trying to help our church with their finances.

The church is giving a cash allowance for medical and retirement $3000 per month.

On the past …

Is a Pastor required to file a w-2

A pastor of a small church the He pioneered. He only receives a honorarium each month. Is he required to file a w-2?

Pastor in church provided parsonage

The pastor lives in a church provided parsonage. The church pays for the utilities (not transferred to the pastor's name).

Let's say the pastor is paid …

Payroll has been deducting SS and Medicare from Pastor's pay check, is that correct?

I'm a volunteer at a small church helping with finances and in reviewing the books I noticed the Pastor is having SS and Medicare taxes withheld from the …

Church accounting for contribution paid to pastors retirement fund

How should you treat a board approved amount of funds to be given to the pastor?

The church does not have an existing plan, but will give pastor a …

A non-minister church employee becomes ordained as a minister in the middle of the year.

An existing church empoyee becomes ordained as a minister in the middle of the year.

I understand that a housing allowance can be established mid year, …

Correct way to reimburse pastor

Our pastor is paid 43,000 a year base pay.

Each month he has our secretary withhold 1,000 which he then turns in business receipts for and gets a check …

Pastor's Utilities Paid by Church

In a situation where our pastor has an agreed upon housing allowance, but the church also has a budget line where we pay his utilities. Should the utilities …

Interim Pastor - Statutory Employee?

My father is an interim pastor for his church and received a W-2 amounts in Box 1 "Wages" and Box 2 "FIT Withheld".

Box 13 was also checked for statutory …

pastor and his wife working together

If a pastor and his wife work together can their salaries be combined and filed together on the pastors w2?

Vickey's Reply : No. In no shape or form …

Clergy housing allowance and SE status for hospice chaplains

I currently work as an ordained hospice chaplain and the scope of the work qualifies me to receive the clergy housing allowance for ordained ministers. …

church pays minister's medicare tax

Should that amount be be included in his w-2 wages?

State Employer Identification Number

I am a new treasurer for our church which also has a new pastor. Our church has never given a W2 before. I have a federal tax Id number but not a state …

Utility/Parsonage Exclusion

My Church gives me a utility/parsonage exclusion. Should that amount appear on the W-2 and where?

Why not include housing allowance in W-2?

Is there some logical reason not to include housing allowance on the W-2 form?

I know that the cleric is not required to pay income tax on the clergy …

Need a official W-2 and W-3

How do I obtain a W-2 and W-3 to complete for my pastor? I have signed up thru the IRS several times but it will not let me download the forms. Tired …

Tax return software that will accept a clergy W2 with box 1 empty

For a minister working part-time and all of his salary is designated housing allowance, what software program will accept a clergy W2 with box 1 empty? …

housing allowance is more than pastor earned this year

our pastors wages for 2019 were 21,250.00, his housing allowance is 24,000.00. how do I show this on hisw2?

Clergy retirement plan

The company pays for our Pastor's retirement plan, do I check the retirement box or leave blank?

W3 reporting form for Pastors W2

if a pastor opts out of FICA, what does the church check on "kind of filer" on the W3. The church doesn't file a 941 or 944 report because there is nothing …

Reporting a Housing Allowance Only

We are a very small church, 20 in attendance on a Sunday, we only give our pastor a small housing allowance. Does a W2 need to be done for this? If so …

employers contribution to 403b

I am preparing W-2s for the pastors in QuickBooks and it is NOT including the Employers 403B contribution in box 12 on the W-2. Is this correct? It is …

Reporting of Pastoral Housing Allowance

Can 100% of a pastors income be reported as housing allowance?

How to do W-2

If a pastor of a small church had a housing allowance only for pay (and it was the smallest of housing expenses actually pd, housing allowance designated …

Should minister 401k contributions be included in SS and Medicare wages on W2

For regular church employees, the ss and med wages is increased by their 401k contributions on the w2. Should the ministers' contributions be as well? …

Expenses

Can I deduct Expenses on a Sch C for SE even if I a paid on a W2?

Pastor Filing 1099

This is our first year that our Pastor has received an occasional stipend from our church.

How do we go about reporting this #1 for our Pastor and …

W2 with no wages but only housing allowance and federal tax withheld

This is my first time filing taxes as a bivocational pastor. I only take a housing allowance from the church.

I had them withhold federal taxes on …

w2 box 1 troubles

I am using the social security on line site to file the w2's for our pastors who receive $24000 and $20,000 annual compensation which is all designated …

First Time Pastor

Would I proceed the way that your example states even if I didn't pay any income taxes?

Wasn't aware of how the process went, nor did anyone at the …

Run paycheck thru payables vs payroll?

If one of our pastors does not want me with withhold their Fed Tax, should I run their check thru normal payables or should I still do it thru quickbooks …

All Pastor's wages/housing allowance reported on 941

I reported all wages/housing allowance on all of our 2018 941 forms this past year. Can I put this amount in box 1 of his w-2 and then put the H.A. in …

What happened to the $9,000

Using the example - I believe you are saying the "cash" amount received for the year is $25,000.

What happened to the $9,000? It isn't subtracted …

The hospital I am a chaplain for withheld social security on my housing allowance!

The hospital I am a chaplain for (I am an ordained minister) withheld Social Security on my entire salary, including the housing allowance.

The IRS …

Form 941 and What is Reported on W-2

Our church reports income tax on Pastor's Gross Salary quarterly on the 941.

When the W-2 is completed, $0 is entered for Box 2, Federal Income Tax. …

Pastor's Severance Pay, reported on W2 in box 1 or box 14?

I'm wondering if a Pastor's severance pay would get reported on their W2 with wages reported in box 1, or in box 14 alongside housing. Thank you!

What qualifies as "actual housing expenses"

I had all my pay distributed as Housing Allowance & received a W2 showing no wages.

I'm trying to determine the "actual housing expenses" but wasn't …

Housing allowance

Is there a code for line 14 when you claim a housing allowance?

W-2 Reporting

How to report on the W-2 employee paid 403b and Health insurance payments deducted from employees salary?

Box 14

Is the proper wording for Box 14 "Housing" or can "Parsonage" be used as well?

Vickey's Reply: Box 14 is an "informational" box for the employee (The …

403b contribution in place of salary

Instead of writing me a check, my church contributes to my 403b plan. Does that need to be reported on a W-2?

Example Pastor's W-2

Why isn't the HA(6000) subtracted from salary when calculating the amount for Box 1?

It's indicated elsewhere that it should be.

Vickey's reply: The …

Pastor only receives a housing allowance; does he get a W2?

Our Pastor does not receive any salary; only a housing allowance. Do I need to send a W2 with box 14 filled out only or what is the best way to handle …

TSA contributions

Where would i put the TSA (Tax Sheltered Annuity) contributions on my W2 form? Would it be included in the Box 14 area?

Retirement fund 403 B for pastors

When a withdrawal is made from a 403 B retirement fund for housing allowance, how is it reported by the Finance Company on the pastor's w2?

How does …

HSA Paid as an Allowance directly to Pastor

My church pays an HSA as an allowance directly to one of our pastors, rather than into the pastor's HSA.

The pastor then deposits it into an HSA managed …

Where do you post taxes withheld on a ministers retirement fund

Our youth pastor dedicates money monthly to go into a retirement fund thru Guidestone and wishes for the taxes to be paid before payment.

He wants …

Housing allowance is part of the my husband's salary

Part of my husband's salary is designated as a housing allowance. So does that part that is housing allowance go on line 1 of the W-2?

Say for example …

Correct information for Pastor W-2

Example: Our pastor and his spouse receive a salaries, housing, two vehicles with insurance, hospitalization insurance, dental insurance, contributions …

how do you correct for a w-2 that has the housing allowance in box1 of the w-2

how do you correct for a w-2 that has the housing allowance in box1 of the w-2

Vickey's reply:

The issuer will have to file a W-2c. If you file the …

Does a minister receive Social Security benefits once he reaches retirement age?

Our pastor of 26 years recently asked me a question that I thought was cut and dry, but in reality I don't think it is quite as cut and dry as I originally …

1040-es and 1040 at income tax filling season.

My question comes based on this scenario:

Our pastor is working a secular job where he gets his W-2 every year with all taxes already taken out. …

Where to report housing allowance not shown on W2

I am a salaried chaplain employed full time by a health care organization.

The organization has confirmed my entitlement to a clergy housing allowance …

1040 ES Filling Instructions for Very Beginners

We are a small church that needs to know how to do the right things.

Seems that only experienced people like you could be helpful for some novices. …

Is a W-2 necessary?

My church only pays me a housing allowance (no regular wage/income). Getting a W2 that has $0 for wages messes up my ability to electronically file. …

Minister's Severance Pay on W-2

I was a minister of a small local church.

The church closed its doors and gave me 6-months severance pay.

On my W-2, they did NOT include the amount …

Utilities Allowance for Pastor

Our pastor receives a housing allowance and a utilities allowance. Should the utilities allowance also be included in box 14 of the W-2?

Vickey's Reply: …

Two W2s for pastor who's title changed mid-year?

If an employee goes from regular staff status to pastoral status mid-year do they need 2 separate W2s or is their income reported on one W2?

minister's only "pay" is his housing allowance. W-2 needed?

I have a minister whose only "pay" is his housing allowance. Does he need a w-2 with box 14 for the amount of the allowance?

Allocating Housing Allowance

Our pastor passed away the first week of May 2016. He was projected to have an $18000 housing allowance that we would have deducted from his gross salary. …

Pastor's Flexible Spending Account (FSA)

Our pastor and one other employee has money deducted each month to put into a FSA (Flexible Spending Account).

How does this deduction get shown on …

amount of cash salary to include in box 1

We have a very small church, of which I am the treasurer.

Our pastor gives us a note with the numbers to write on his W2.

We pay all of his utilities …

employer paid contributions to a pastors retirement

Where do I include on w-2, if anywhere, the employer's contribution to our pastor's retirement plan?

Create a W2 for a Youth Pastor whose only compensation is living in church parsonage

Hi, Our Financial Secretary died suddenly and I am trying to do the W2's forms for 2016.

I am not sure how to proceed with creating a W2 form for …

Form W-3

If the ordained minister is the only church employee, are churches required to file for W-3 with the Social Security Administration?

Gift of vehicle to pastor

Where to report the value of a vehicle given by church to pastor?

Clergy witholding

I receive clergy pastor pay $7,800 and a second job at the church that is non clergy at $7,400. I also receive 16,000 clergy housing allowance. IRS sent …

FSA and retirement withholdings

Where would Pastor directed deductions for a Flexible Spending Account (FSA)and voluntary contributions to their 401K go on the W-2 form?

thank you …

Retirement withholdings

If a minister has retirement coming out of his paycheck, but the Church does not have a retirement plan set up.they just turn around and pay the amount …

Filing ministers housing allowance

Does the housing allowance go on line 16 for State wages

Cell phone paid by church

Our church pays for the pastor's cell phone that he uses for church and personal, do I add this amount to his W-2?

Ministers as statutory employees

Are ministers considered statutory employees in Box 13 on W2?

How do I get a W-2 form for our Pastor ( new treasurer with NO training on how to do this) ?

I am a new treasurer with NO training on how to do a W-2 form (or whatever form ) is needed to give to our Pastor for services rendered . He was also paid …

Withholding social security allowance

We have a ordained/licensed pastor we pay $200 a week. The deacons voted and want to start paying the "employer" portion of the SECA tax, 7.65% being …

I have filing question?

I took a salary reduction to have money designated as Social Security allowance which I received quarterly to pay my Self employment taxes. Is that allowance …

Health Savings Account

What are the guidelines for a pastor's health savings account and is it reported as a benefit or taxable income?

DO I ENTER ANYTHING IN BOX 3 SOCIAL SECURITY WAGES FOR PASTOR WHO HAS NOT OPTED OUT OF SOCIAL SECURITY

DO I ENTER ANYTHING IN BOX 3 OF THE W2 FOR SOCIAL SECURITY WAGES FOR THE PASTOR WHO HAS NOT OPTED OUT OF SOCIAL SECURITY?

Preacher with 0 wages

How do you properly fill out a w2 on a tax return when the preachers only income was the housing allowance and boxes 1 and 16 are 0. State and Federal …

Housing Allowance and Mortgage Interest

If a Minister has a housing allowance and deducts expenses for the house he owns, like mortgage interest, taxes, utilities against it; Can the mortgage …

W2

Our priest has a salary of $7800 per year. He lives in a house that is church' property. Can I add $24000 to his salary and write in W2 form that he received …

Budgeted funds Transfered to another account

We have multiple checking accounts amongst our little church. Fund accounting is something that has not been introduced yet.

We have a general budget …

Housing Allowance ?

Our church has a parsonage. We pay our pastor a salary and have designed $9600 as housing allowance. The housing allowance is not added to the gross wages. …

Excessive Housing Allowance?

For 2014 my Pastor's W2 reflects a salary of $5,150 in box 1 and a housing allowance of $96,750 in box 14. This year there will be no salary - just the …

Health Insurance Payments

With the new PPACA rules, do I put all the contributions made by the church on the Pastor's behalf in box 12 with a DD designation?

W-2 Question

I need help filling out our Pastor’s W2. His salary is $60,000 with no withholding on income tax, social security or medicare tax. The housing allowance …

Does the W2 Block 1 Total income include the Housing allowance?

The way I read the W2 instructions the preacher's total Income goes in block 1 (not Income - Housing allowance) and then put the housing allowance portion …

Travel Insurance

In a non-profit 501c3 ministry, can the ministry pay for travel insurance for the traveling minister when it includes a death benefit for the spouse (as …

How to complete section on Pastor's W2 for state taxes

Should I complete sections 15 - 20 if I do not withhold state taxes? In the past, I have input the state and the state ID number and not amount. What …

Recording of Housing Allowance on W-2

Is it required to list the housing allowance amount in Box 14 of a W-2 or can the church just issue a letter to the minister with the amount paid to him …

SELF EMPLOYED MINISTER

OUR PASTOR IS PAID AS A SELF EMPLOYED MINISTER. I DO GIVE HIM A W-2 EVERY YEAR. WHAT FORMS DO I NEED HIM TO SIGN WHEN HE IS HIRED (W-4, NEW HIRE REPORTING …

Sending a W-2 to a Minister's requested non-profit for the service he rendered .

If a leader receives a check betweem $10,000-$20,000.00 for services rendered for the year from a non-profit religious organization for providing leadership, …

Credit report for our church?

We would like to determine if we have outstanding credit cards that we don't know about - could have been issued to employees in past years.

Our banker …

Voluntary withholding of taxes for Pastor

What is the process for Pastor to request voluntary fed and state taxes be taken out of his check?

Housing allowance and self employment tax. Please help.

If the pastor only receives housing allowance and no salary does he have to pay self employment tax on the housing allowance? What is the benefit of paying …

Housing Allowance Put in box 1 of W-2

My treasurer included my housing allowance as part of the salary in Box 1 of my W-2. How can I deduct my housing allowance when filing my taxes?

Minister - Self -employeed but electing Employee treatment

Can a minister elect out of self-employed treatment? I don't mean the election out of social security taxes, I mean actually electing to be treated as …

ALL Monies Paid to Pastor are for Housing Allowance

All compensation we pay our Pastor is for Housing Allowance. This amount goes in Box 14 but does it also need to be listed in Box 1?

Part-time minister opting out with taxes.

If a part-time minister opts out of social security taxes via 4361, yet still pays into social security on his regular job, will he still be eligible for …

Pastor acquires more business expenses than his salary

We pay our assistant pastor $500/month, but he often acquires more than that for business expenses related to the church. We have an accountable reimbursement …

Our church pays for internet services. When is it pay?

Our church and adjacent parsonage allows internet service via wifi in both locations. The church pays for the internet service which the Pastor uses for …

What if the church makes the monthly payment to a Health Care Sharing Ministry for the pastor?

The church makes the monthly payment for our pastor to a Health Care Sharing Ministry. I reported it in box 14 on his W-2 as insurance. Should I change …

Medicare?? SS??

Is it bad if we have been taking out SS and Medicare? Since I started helping they have been doing it and that has been 8 years ago. someone told them …

Federal Tax Withholdings

Example: Pastor Salary is $12,000 for the year. He has elected through W-4 to have $200 federal taxes withheld per month. So will box 1 of W-2 read 9600 …

W2 and W3 Housing Allowance Only

The church approved a housing allowance of up to $20,000 for our Pastor. This year he was only paid $16,000, so he really did not receive "salary", only …

W2 Not Showing Housing Allowance

When entering the Housing allowance in the W2 using QuickBooks, I used box 14 and entered the amount as per your example. However, once I printed the W2, …

Gas allowance for ministers

I travel to and from church for church related services 3 times a week. I also travel on non-services days for ministerial duties. Each round trip is …

Witholding Tax credit?

There is a tax credit for churches if you pay in witholding tax. We have not paid witholding tax in the past, but we were told to start witholding from …

housing allowance paid to or for the pastor

how to handle: pastor housing expense is paid for him by the church, instead of him receiving a housing allowance?

Minister's W-2

In SC, which items from the Ministerial Support Form go onto the W-2, and on which lines?

Are 941 forms required if pastor is only employee?

If the pastor is the only employee, does the church need to file 941 forms. Or can we simply file a W-2 and W-3 at the end of the year. He does not have …

moving allotment

Our church paid our new minister a moving allotment .. to cover his moving expenses. He was paid directly $7,250 (no receipts requested or accountability …

Enter zero in Box 1 on W-2 if all salary is designates as housing allowance?

We have a part time minister who earns 7500/year which our Board has designated entirely as housing allowance. He has opted to have us withhold taxes to …

How to report annuity to a pastor?

I am trying to do the payroll for our pastor. We pay 166.66 monthly to our pastor as an annuity. Is this amount included in taxable income - or is it nontaxable …

Board of Pensions

Where is the money paid by the church on behalf of the pastor to the Board of Pensions shown?

1099 or W2 for visiting clergy?

Our full time Pastor retired in July, we have been paying an Interim Pastor a monthly stipend to oversee business affairs but he rarely preaches. We have …

W2 - Housing Allowance Only

Our Pastor does not receive a salary from the church. He does, however, receive a housing allowance. Should we be filing W4 or W2 just for housing allowance? …

how to count the housing allowance

we do not pay a housing allowance separate from actual salary it is included in salary so do I minus it from salary then report it in box 14?

Housing Allowance Adapted Resolution

I looked at your sample adapted resolution for a pastor's housing allowance. Our church does not own a parsonage but wants to pay directly the mortgage …

W-2 Housing Allowance

We made a serious error on our minister's W-2 for 2012 and are trying to correct it by putting the right numbers in the right boxes.

His housing allowance …

Part Time Lay Minister W2

I am a part time lay minister, ever other week at a very small church. I receive a small amount for each service, no housing, no insurance, no gas or …

State and Local Taxes Relative to Housing Allowances

In the state of Ohio, should state and local taxes be withheld for a minister's housing allowance? If so, should the amounts in boxes 16 and 18 of a minister's …

Clergy pays own health insurance premiums.

Is the amount a clergy pays for personal health insurance allowed as an allowance just like his housing allowance?

W-3 Tax form for ministers housing allowance

On what line of the W-3 tax form do you record the ministers housing allowance

Church donation to the minister's IRA

If the church has decided to donate $2000 a year to a minister's IRA.....how is this done? Does the church write and send the check to the account on …

403(b) reporting on W-2

The church paid the pastor $20,000 in wages and $10,000 in housing allowance. $1000 was withheld from the pastors wages and put in a 403(b) plan leaving …

education loans

If the church pays the pastor's education loans to him, is this income to him? What if they pay the loan institution directly?

State Identification number

How does a church find out what it's state identification number is?

Pastor is ONLY paid housing allowance. No other income or salary is paid.

Pastor is ONLY paid housing allowance. Hence, w2 lists $18k in box 14. Question: How to complete w2? Form requires a non-zero number in at least one box. …

Pastor W2 and Housing allowance

OK, long post. Our Pastor makes 35k annually. Has 15k in housing allowance. We withheld no federal or state tax. We withheld his portion of SST (4.2% …

Social Security tax allowance

If the church has agreed to pay half of the Social Security Tax and that amount is added to wages in box 1, doesn't that mean that the pastor will be paying …

Confused!

If my pastor receives a 1099 form is he still allowed to receive a housing allowance? How do we set up a housing allowance?

Love this website,

Faye …

Value of Housing, NOT Housing Allowance

I am a new pastor living in a provided parsonage home. The home is a stand-alone residence, detached from the church building. Value is calculated as …

Box 2-13 on Pastor's W2

Your instructions for filling out a Pastor's W2 states: "Leave boxes: 2, 3, 4, 5, 6, 7, 8, 9, 10, 11, 12, and 13 blank. Do not insert 0s."

I file our …

Is it true that the housing allowance needs to be subtracted from the pastor's salary on the W2?

I have this argument with the pastor every year. I have told him the housing allowance is not reflected on the W2 anywhere other than box 14. That is …

Minister ordained in Mid-year

Our minister became ordained on May 31st. We paid her SS & Med taxes throughout the year and withheld income tax for her. Do I need to give her two W2's? …

Do I report Accountable Reimbursement on W2?

How does the church report accountable reimbursement?

Taxes Withheld Per Minister's Request

I assume that we report any Federal taxes withheld per a minister's W-4, Line 6, requested amount, would be reported in Box 2.

What is included in housing allowance?

Our pastor lives in our parsonage, the church pays the mortgage, garbage, water, electric, lawn care, all repairs and upkeep for the property so should …

How to report Housing Allowance to Social Secutity

If we pay a pastor and 100 percent of his pay is considered houseing allowance, how is it reported to Social Security? I cannot do a W2, because he has …

How does the IRS know that the W-2 is a pastor's?

How does the IRS know that a W-2 belongs to a pastor and that the church just didn't withhold FICA and medicare?

HEALTH INSURANCE

WE REIMBURSE OUR PASTOR FOR HIS HEALTH INSURANCE PREMIUM. DO I INCLUDE IT IN THE TOTAL WAGES OR NOT?

Gas Allowance Reportable on the W-2 form?

Should an "opted-out" pastor's gas allowance be placed on the W-2 form?

Are grant funds to the church taxable for the pastor?

Our church was the recipient of a large grant, to be used for my husband's (he is the pastor) sabbatical. While some of these funds will be used within …

Offering Collected for Pastor's Anniversary

The church took up an offering for the pastor anniversary do you have to include it in his salary?

How does the Social Security Admin know the proper amount of income ?

Where is the proper amount of income reported to the SSA so that they may know the tax amount due from someone in the clergy? The information I find says …

Self Employment tax

Are ministers liable for self employment tax?

FORM TO REPORT PASTOR INCOME

WHAT FORM WOULD YOU USE TO SHOW A TAX EXEMPT FOR A PASTOR'S INCOME

Retirement Accounts

How are employee contributions to a retirement account documented for a pastor? Do they need to appear on the W2 form?

how to report gifts

For a minister - how are gifts reported on 1099? how are gifts reported on W-2?

Housing Allowance subject to SE tax?

If a pastor already opt out of SE tax on his W-2, is the housing allowance also not subject to SE tax?

Why wasn't any federal tax withheld on the $25,000?

Why wasn't any federal tax withheld on the $25,000?

How should church set up funds to help with the Pastor's self employment tax?

We are a small church of about 100 members. We want to help pastor paying his self employment taxes, however not sure how if the church should get a seperate …

4361 exempt

where on 1040 do i report my husband's wages(ordained minister)which were reported by church on w-2. irs says to report it on selfemployment line and …

can church staff recieve a housing allowance

Can church staff recieve a housing allowance?

How to Report Housing allowance

Our Pastor's salary is 30,000 for the year; the church has designated 18000 for housing allowance.

Should we subtract 18000 from 30000 and report 12000 …

Self Employment allowance

How can we break the circle. We figure out the Self Employment Tax for the priest. We give him an allowance for the entire amount. We add the entire amount …

Mistake in Example

In the example above, it shows the pastor's salary of $25,000 + 2500 + 6000 = $33,500, then the whole thing is put in Box 1. That isn't right. It should …

Tax Exempt

Our church was informed we had to pay taxes due to the IRS moving us from a 944 form to a 941 form without notification. How does this work?

what is the level of pay where a W-2 is required?

As a new church, we started to pay our pastor a housing allowance of $4600 this past year along with a salary

of $10 (just to be able to satisfy the association …

Once self-employed, now employee of same church

My husband, an ordained minister, agreed to do supply preaching for a certain church beginning the last Sunday of November, 2011, through all of December, …

Church withheld SS, Medicare and Local Tax on Pastor

I am a pastor and my church withheld Federal, SS, medicare, and Local taxes.

I believe they sent payments in for these areas. These withholdings …

How do I fill out W-2 when no taxes are withheld from paycheck?

No taxes are withheld from our pastor's paycheck. She pays estimated taxes. Which boxes should be filled out on W2. She does participate in retirement …

Wages box is empty, all earnings housing allowance-bi-vocational pastor

My W2 has all my earnings listed as housing allowance and ZERO wages, what value should I put in the wages box?

vickey’s reply

If your church …

Minister opted out of Social Security but now church is withholding

I have a minister that opted out of Social Security about 5 years ago but this year his W2 shows they took Social Security out on him last year. How do …

Pastor's W2 sent to SSA and state tax office?

Our church gives the Pastor a W2. He has opted out of Social Security and no taxes are taken out for federal or state as he pays estimated taxes himself. …

compenstation

is it mandatory or mandated by law that the Pastor be issued a w-2 for his compensation? can a Pastor request to receive his compensation as a Housing …

Housing allowance in Georgia

I know how to complete the w-2 as far as federal wages are concerned, but I can't find out what to do for the state portion. In Georgia is the housing …

collapsible transaction theory?

This is my first year as treasurer. Last year my pastor went to have his taxes done and was told to get a new W-2 that has his wages on it minus the ammount …

What happens if we paid our pastor like a regular employee?

When I became the bookkeeper at our church the two staff pastors were both being paid as regular employees with the church paying ss tax and the pastor …

Only paid our pastor a housing allowance, still issue a W-2?

If all we paid was a housing allowance, do we still issue the pastor a W-2?

vickey's reply

Yes you can. Report it in Box 14 on the W-2. Leave …

How do I fill out the W-2 if the pastor has opted out of SS tax?

Our pastor is the only pastor and is probably considered an employee, although we haven't made an official decision on it during council or anything. However, …

W2 vs 1099 Pastor salary

I have a 1099 for our pastor, where do we put his salary?

I put is medical helath insurance in Box 6 and his housing allowance in box 7, where do i …

Is housing allowance included on the W2 in box 3 and 5?

Our pastor receives a housing allowance and I need to know where to properly enter it on the W2.

Now I know that it doesn't go in box 1 but I am new …

Are W-2's required

Are we required to give our Pastor a w-2 FORM and is it his responsibilty to report it? What do we with our copies?

We are new to this and I'm not sure …

w-3 transmittal form

The pastor has an housing allowance of $12,000 and income of $10,000. He shows income in box 1 of the w-2 wages and shows $12,000 housing allowance in …

Is it correct for church to leave box 3 on W-2 blank?

Is it correct for church to leave box 3 on W-2 blank?

If so, when Social Security Admin computes and average 35 highest years of "wages" and if Box …

What is EIN

What is EIN ?

vickey's reply

Employer Identification Number. If you need to apply for one you will need to fill out IRS Form SS-4.

See …

Is Medical Insurance Premiums Taxable Income?

I've been the bookkeeper at our church since February (so this is the first time I've issued a W-2 for our pastor.)

Our pastor and his family are …

pastor or clergy allowances that are tax free

What is the maximum amount a clergy can receive as housing allowance?

What is maximum number of for miles and that a clergy does not have to report …

Allowance added to wages on w-2

My allowance was include in my wages on my w-2 how can I fix this because now the IRS says I owe them more money. I have an agreement with the church I …

W-3 Transmittal of Wage and Tax Statements

I issued a W-2 to our Pastor who receives only a housing allowance for wages. I checked box 14 Other and wrote in Minister--See Sch SE and then the amount …

Clergy Mid Year Status Change ReMiX (from regular w2 employee to ordained minister)

Clergy status change... Does it retro or do I prorate?

Our worship minister was ordained mid year and prior to that, fica/mc taxes were withheld. …

Minister's taxes withheld incorrectly

If Minister had fed, social security, and Medicare taxes withheld in first quarter of the year , but not the next 3 quarters . How can this be corrected …

w-2---can it be handwritten or is there free software to print them with?

I have to get a W2 out and bought some forms from the office supply store, but don't know if I can handwritten or if there is software to print with?

…

Sending in W-2 to SSA if Minister is Exempt

Does the church have to send in a W-2 and a W-3 if the Minister has filed Form 4361 and is exempt from Social Security and Medicare Taxes?

vickey's …

Advice for W-2 form

Question regarding an error on a W-2 for a minister:

Thank you for your confirming my thought about the taxable income. Here is the situation I really …

Minister Did Not Complete a W-4 Form

We paid the minister a small salary monthly; however, no taxes were withheld. A W-4 form was not completed. Is there a problem with issuing a W-2 at this …

Including Dues Wages on the W-2?

Are dues wages on the minister's W-2?

Vickey's reply

I found this on About.com "Understanding Form W-2:

Your employer may report additional …

W-2 for Pastors

Do we issue W-2's to pastors if they do not have any tax taken from their checks? And if this is the case how do you report it on the 941 form so that …

Issuing W-2s

I have been the pastor at my church for a little over a year. I recently discovered that we have not been issuing W-2's to the pastor or our musicians. …

The comments above are for general information purposes only and do not constitute legal or other professional advice on any subject matter. See full disclaimer.