25 Year End Tasks and Reminders!

It's time to begin closing out the year for your church or nonprofit! Take a moment to review the year end checklist below that will outline the necessary steps to ensure a seamless transition into the new year with your accounting, payroll, budgets, donations, reimbursements, and more.

Coupon!

Here is a 10% discount code for all the ebooks, spreadsheets, and packages on this site:

FCA

Note: click on "PACKAGES" in the top navigation bar for a list of all of the ebook and spreadsheet packages on this site!

As the year end draws near, one of my initial tasks is to generate a report from all my clients' accounting files that provides a summary of the year's transactions "by account." Here are a few key areas I focus on:

1. Gift Cards: I check for any gift cards purchased for staff, gifts, prizes, or charitable purposes, as these must be "tracked"! We try to monitor these purchases right away so we can set them up in a "cash on hand" account within the accounting system. We treat the original purchase of the cards as a "transfer" from the bank account to the new "Gift Card" register. Each time a card is used or given away, we need to manually enter the "expense" ... until that "cash on hand" account is zeroed out. Lisa London, my co-writer on our How-to book for churches, has a great article on how to handle gift cards on her "accountant beside you" site AND provides a free log that you can use to track those gift cards!

2. Potential 1099 payments: I'll delve deeper into this more below, but it's important to note that there is a specific form required for payments to independent contractors that exceed $600. Guest speakers are a prime example of individuals who might need a 1099-NEC form.

Starting in October, we pull "vendor summary" reports to identify who may require 1099s and ensure we have their W-9s. I export this report to Excel, sort it from highest to lowest, and remove entries under $600 for the year. Next, I refine the list by eliminating corporations and nonprofits (who do not need 1099s). We then proceed to collect W-9s for those who qualify. After closing the books for the previous year, we revisit this report in January to verify totals and check if any independent contractors have reached or exceeded the $600 threshold.

NOTE: Do not issue 1099s for recipients of benevolence payments! However, ensure that these payments are well-documented and disbursed in accordance with the guidelines of your benevolence fund!

3. Investigate Negative Amounts: In the "transaction by account" report, I look for and examine any negative amounts. Refunds are typically posted back to the expense account associated with the original transaction, so not all negatives are problematic. However, we often find instances where a "check" has been mistakenly applied to the wrong account, either income or expense. Address these issues before closing the books for the year. If an error occurred in a past month with reports already issued, a journal entry may be necessary to adjust your totals.

Any negatives found in the Balance Sheet or Statement of Activity should always be investigated and corrected if needed. QuickBooks Online users should note that there should never be a balance in the equity account labeled "Opening Balance." If you find one, seek guidance online on how to resolve it before finalizing the books!

Bookkeeping for Churches Package

A set of 4 ebook that covers the following topics...

- Fund accounting examples and explanations

- Best methods for tracking restrictive funds

- Basic accounting concepts

- Examples and explanations of financial statements

- Chart of Account breakdown

- How to record income, expenses, payroll, etc.

- Much more - Click here for details

Year End Employee Follow-up

4. Determine housing allowance: Designate the housing allowance for ministers for the upcoming year ...before this year end.

If you already have a housing allowance set up for your minister, you need to review it, adjust it (if applicable), and get it officially approved and documented before the year end.

Note: Even if you have included the wording “for current year and all future years” or something similar, you still need to review and approve it every year and show that approval in your minutes. Most minister’s housing expenses do not remain the same every year so many times adjustments need to be made.

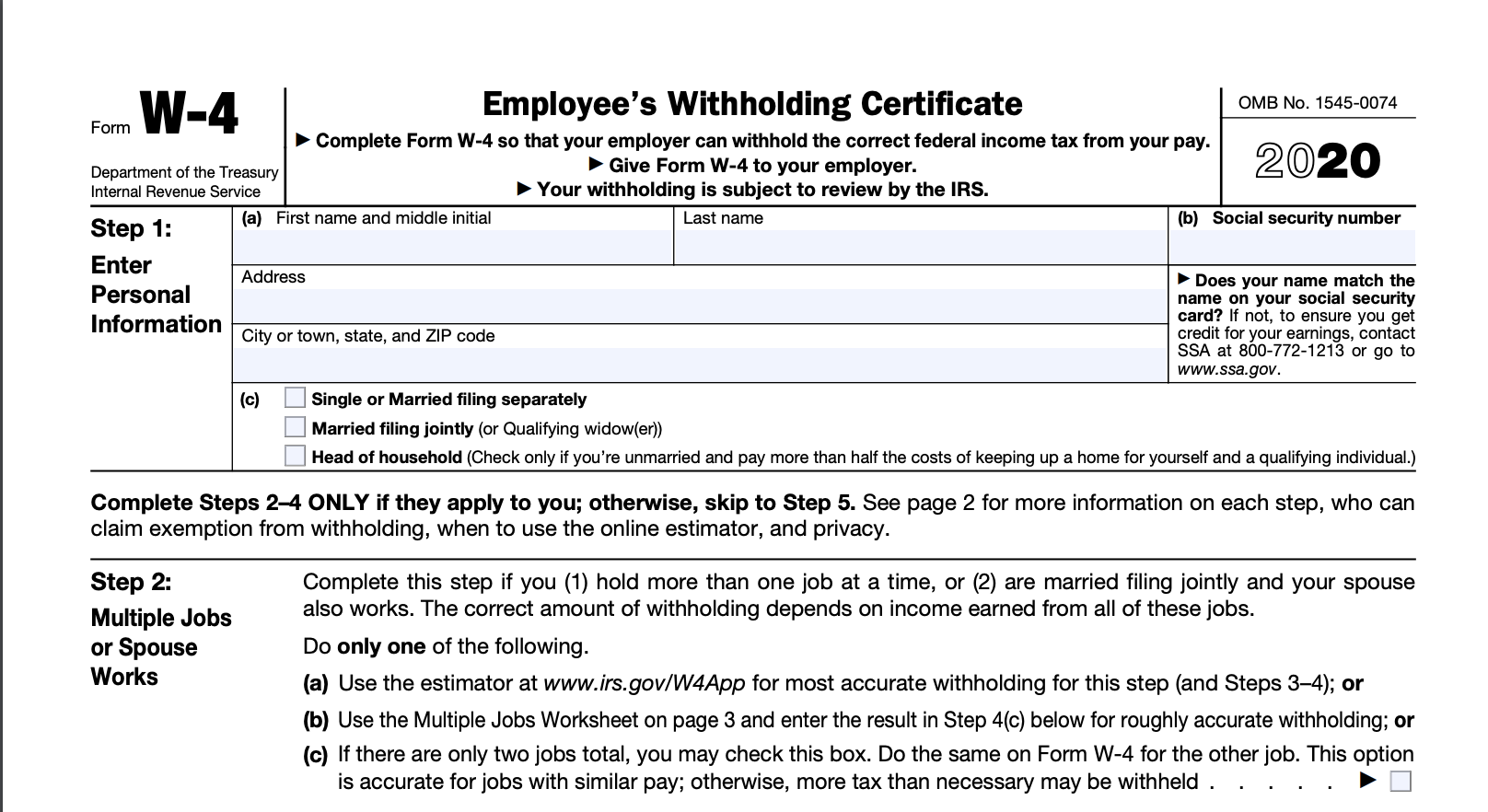

5. New W-4: REMIND your employees on or before January 1st that they may want to complete and sign a new W-4 ... if their filing status has changed due to marriage, divorce, or dependents (child turned 21, birth, adoption, etc.), If none of these situations apply, the form you have on file is typically fine for the upcoming year. However, if you're implementing a new payroll system, it may be advisable to obtain a new W-4 from everyone.

6. Employee Classification: Ensure that you accurately identify any worker who should be classified as an employee. The beginning of the year is an ideal time to make these classifications. See this article on Misclassification of Workers. Remember, if you are usure if your worker(s) would be classified as an independent contractor or not...it is better to error on the side of caution and classify them as an employee. Also...if you see that you have incorrectly classified a worker as an independent contractor, you can take advantage of the Voluntary Classification Settlement Program to reclassify that worker as an employee for employment tax purposes for future tax periods with partial relief from federal employment taxes.

See this page for more information on determining whether or not your minister should be considered an employee.

7. 1099 Prep: Review all payments made to service providers such as

- guest speakers

- lawn care providers

- pest control providers

- repairmen

- plumbers

If you paid them $600 or more collectively throughout the year and they are not a corporation, you will be required to file a 1099 and provide the independent contractor with a copy. AND...don't forget...you have to file those before Jan 31st! NOTE: the new form for those types of payments is the 1099-NEC.

Also remember that you may have to file a 1099-MISC for those rent payments you paid the landlord...if they are not a nonprofit or corporation!

The Church Accounting: How To Guide devotes a whole section of the book to payroll for churches. It covers payroll terminology and forms and then takes you through the steps necessary to set up a payroll, calculate and file the necessary taxes and forms, and even details how to handle the minister's payroll. It also includes sections on filling out IRS forms: 1099-Misc, 1099-NEC, and 1096.

If you have QuickBooks or are considering using it in the future, go ahead and purchase the QuickBooks for Churches and the How To Guide combo for a complete package on setting up and administering a payroll using QuickBooks.

Year End Reminders

8. Annual contribution statements: Donors are required to obtain a written acknowledgment from a charity for any individual contribution of $250 or more before they can claim a charitable contribution deduction on their federal income tax return. However, many donors may not realize that they need to secure and retain a "contemporaneous (made at the time or shortly after an event occurs) written acknowledgment" from the church or nonprofit - IRC 170(f)(8)(A) ... before filing their taxes.

In order for a donation receipt to be considered "contemporaneous" the written acknowledgment must generally be obtained by the donor no later than the date the donor files the return for the year the contribution is made.

Therefore, it’s crucial to inform your donors now! Display this information on the bulletin board, distribute handouts, use bulletin inserts, and remind them not to file their taxes (if they intend to claim charitable contribution deductions) until they have received their annual contribution statement. Provide them with a date they can expect to receive it, such as January 31. Note: Due to recent tax laws, fewer taxpayers are claiming charitable contributions, but there is a movement to allow all taxpayers to claim a tax credit for these contributions, making the tracking of donors and donations essential.

With the rise in online giving this year, I want to emphasize one more point about sending out annual contribution statements. If you've recorded your online donations in your tracking software, ensure that you credit each donor for the full amount of their donation. Some churches I worked with this year were unaware that, even when a donor pays the processing fee, you must record the entire donation on their giving record. For instance, if Mary Smith donated $100 and also covered the $3 processing fee, you should record $103 on her donation record, not just $100.

9. Early and more frequent giving statements: Consider sending out quarterly giving statements or a December statement including their current donation balance along with a "gentle" reminder for year-end giving.

Include a return envelope or a link to your online giving page to facilitate their response. People often feel more generous during the holidays and are likely to evaluate their year-end giving options.

10. Recognition of donations: Donors must give their contribution checks on or by December 31st to be included in the church’s prior year written acknowledgement of their contributions.

If a check is received in the offering on or after January 1st, even if it was backdated for December of the prior year, it will not be included in their prior year annual contribution letter.

However, if the donation is mailed, all checks received in January of the new year that was dated and the envelopes were postmarked in December of the prior year ... will be deductible for that prior year, even if received in the new year.

Donation Guidelines Package

A set of 4 ebook packages that covers many of the following topics...

- How to handle and receipt stock donations

- How to handle free rent and labor donations

- How to handle non-cash contributions

- What to do if you receive a DAF (donor advised fund) contribution or grant

- How to handle Quid Pro Quo donations and other fundraising income such as drawings and raffles

- Donation policies and procedures

- Much more - Click here for details

11. Appreciation Gifts: This time of year often brings opportunities to present gifts to our volunteers and staff in celebration of Appreciation, Thanksgiving, Christmas, and more. However, when these gifts are given to employees, they may be considered taxable income, so it’s essential to manage these carefully and document them as required.

An exception to this rule includes:

- De minimis gifts: These are gifts valued at less than $25. Note that cash, gift cards, or any cash equivalents do not qualify as de minimis gifts, regardless of their value.

- Employee achievement awards: To qualify, there must be a written, nondiscriminatory award program that offers awards based on longevity goals or safety standards, adhering to specific requirements regarding gift types and amount limits.

These regulations also apply to volunteers if their gifts total $600 or more within a calendar year. In this case, you may need to report the total on a 1099-NEC, as the IRS views these "gifts" as compensation for their services to your organization.

Refer this article on Staff Gifts for more information.

12. Reimbursements: If you have an accountable reimbursement plan in place (which you definitely should, regardless of your organization's size), ensure that all reimbursement claims are submitted before the year's end. This is also a great time to review all reimbursements made by your church or charity to staff, volunteers, or board members throughout the year.

Verify that each reimbursement is supported by a receipt and qualifies as a nontaxable reimbursement. If you have not received a receipt or supporting documentation from the recipient, or if the reimbursement does not align with your accountable reimbursement guidelines and IRS regulations, further review may be necessary, and you might need to add the amount to the recipient's reported taxable income. Additionally, ensure your accountable reimbursement plan is updated, particularly for amounts like mileage rates that may require adjustments before year-end.

NOTE: Do not give the rest of the monies in your reimbursement funds to your minister or any other employee as it will make all the year’s reimbursements unaccountable. All reimbursements would then be required to report in box 1 of their W-2!

13. Review, update, and adopt policies and procedures such as

See how to create or update your policy and procedures manual!

The Policies and Procedures Package includes an ebook on Receipts and Reimbursements that explores the management of receipts and supporting documents.

Additionally, it provides insights on establishing and managing an efficient accountable reimbursement policy.

Includes a sample of a resolution you can use to present to the board to set up and approve an accountable reimbursement plan.

.

This ebook is included in the Policies and Procedures Package. However, you can purchase it by itself for only $7.95 by clicking the ADD TO CART button below!

The Receipts and Reimbursements ebook is also part of a larger "Policies and Procedures" Package" that is packed full of valuable information and for a limited time you can purchase all 5 ebooks and 8 policy templates for only $32.80

Year End Accounting Tips

I included some accounting "reviews" at the start of this article. Here are additional year-end tasks to ensure your accounting is prepared and ready for the upcoming year!

14. Ensure that all revenue and expenses are recorded before closing the books. This includes transactions such as donations, other revenue, reimbursements, purchases, and payroll (taxes, retirement, flex spending, and insurance).

15. Generate annual reports to verify accuracy.

16. Reconcile all bank and credit card account balances, as well as your Petty Cash and PayPal accounts. Don’t forget to align your accounting records with your donation tracking software, especially if you use tools like QuickBooks or Planning Center. Refer to this article on Financial Statements Preparation for bank reconciliation tips.

17. Confirm any fund balances that will be carried into the next year.

18. Ensure all your bank account signatories are current.

19. Prepare your budget for next year! Review your budget assumptions and adjust them based on any new financial information or strategic plans. This will help ensure your budget is realistic and aligns with your organization's goals.

20. Assess your fixed assets and perform an inventory check. Update your records to include any new purchases, sales, or disposals that occurred during the year.

21. Evaluate your internal controls and make necessary improvements to safeguard your financial assets and ensure compliance with relevant regulations. Review this article on internal controls for a church or nonprofit.

22. Conduct a financial health check by analyzing key financial ratios and metrics. This can provide insights into areas where your organization can improve efficiency and financial performance.

23. Prepare for an external audit if required. Gather all necessary documentation and ensure your records are in order to facilitate a smooth audit process.

By addressing these year end accounting tasks, you'll be well-prepared to close out the year confidently and start the new year with a clear financial roadmap. Remember, staying organized and proactive in your accounting practices can save time and prevent headaches down the line.

Spreadsheet Package

The Spreadsheet Package includes:

- Contribution Tracking Workbook

- 5 Fund Automatic Accounting Workbook

- Bank Reconciliation Workbook

- Collection Count Sheet

- Mileage Log Workbook

- Much more - Click here for details

PLUS a Word document with 3 examples of contribution statements for cash, non cash, and quid pro quo donations that you can customize for your own use!

Changing Software at Year End

24. Transitioning to a new year is also the perfect time to change to a new church accounting software. If you are in need of church accounting software at a great price, try out Aplos!

QuickBooks Online is another great option for church ... especially if you can get a file through TechSoup! However, since this software is essentially created for "for profits" ... consider hiring a knowledgeable accounting firm to set it up for you and even teach you have to use it effectively!

QuickBooks Online® for Churches and Not-for-Profit Organizations

This book contains hundreds of screenshots that helps you set up and use QuickBooks Online (QBO) effectively.

Topics include:

- Procedures to guard against theft and errors

- Designing a chart of accounts (with examples for different types of nonprofits in the appendix)

- Converting a desktop QuickBooks organization into QBO

- Tracking donor gifts and grants

- Importing donor and vendor contact information

- Receiving money, paying bills, and tracking credit card charges

- Reconciling accounts

- Budgeting

- Designing management reports

- Month-end and Year-end procedures

- Tracking fundraisers, in-kind donations, volunteer hours

- Manage member dues, fundraisers, and trips

- Allocate overhead to programs & grants

- Sample charts of accounts for associations, PTAs, private schools, scouting troops, and civic groups

- And so much more!

25. EVALUATE YOUR PAYROLL! If your payroll service is deducting FICA for your minister, this is incorrect. Many churches mistakenly believe that withholding Social Security and Medicare taxes from a minister's paycheck is optional. However, the IRS clearly states that ministers have a dual status, and withholding and matching FICA is not permissible.

Managing payroll can be a daunting task for churches, nonprofit organizations, and small businesses alike. This is particularly true for many churches and nonprofits that depend on volunteers or non-accounting staff to oversee their payroll. Many assume that using a payroll service or software guarantees compliance.

However, church payroll and the associated tax issues should be managed by experts familiar with church-specific compensation matters, such as the pastoral housing allowance and the unique tax requirements for ministers, rather than by standard payroll services that may lack this specialized knowledge.

The Compensating Ministers Package includes three ebooks on how to compensate and pay your ministers; what minister benefits could potentially hurt the minister and the church; how to set up a housing allowance and report it; and how to handle ministers' gifts/love offerings. Also includes an example of a W-2 for a minister.

Additionally there is a sample of a resolution you can use to to set up and approve a housing allowance for your ministers; an estimate worksheet for the minister to use to help the church determine the amount of the housing allowance; and an example of a notification letter the church can use to inform the minister on the amount of housing allowance payments paid during a calendar year.

All 3 ebooks are only $18.55 PLUS you can use the discount code: FCA for an additional 10% off!

Additional Year End Tips for Churches

Reflect on the past year's events, gather feedback from congregation members, and evaluate successes and areas for improvement.

Consider hosting a year-end meeting to celebrate achievements and set new goals, while expressing gratitude to staff and volunteers.

Update the church calendar with important dates and events for the upcoming year. Lastly, appreciate the community and fellowship developed over the year, and look forward to new opportunities in the year ahead.

Year-end tips written by Christy Qualle from Aplos and Vickey Richardson, editor and author of this site and The How-To Guide for Small & Growing Churches