Bookkeeping for Churches Package

Managing bookkeeping for churches is no easy task! If you've ever handled accounting for a church, you're familiar with the unique challenges it presents. In addition to standard accounting practices and methods, you must also navigate tracking restricted funds separately and in conjunction with overall accounting records.

Perhaps you're dealing with a chart of accounts that previous volunteers have overloaded with hundreds of unnecessary accounts. Adding to the complexity, you recently discovered errors in your payroll recordings. These series of ebooks on church bookkeeping are tailored just for you!

Coupon!

Here is a 10% discount code for all the ebooks, spreadsheets, and packages on this site:

FCA

Note: click on "PACKAGES" in the top navigation bar for a list of all of the ebook and spreadsheet packages on this site!

Bookkeeping for Churches Package

Included in this package are all 4 ebooks listed below and the Chart of Accounts Template for QBO (details on the Chart of Accounts page)

Bought separately, you would pay $36.80, but for a limited time, you can purchase all 4 eBooks in the Bookkeeping for Churches Package and the COA Template for only $27.60 That's a 25% discount!

Book 1 in the Bookkeeping for Churches series:

Understanding Fund Accounting

Delves into the ins and outs of fund accounting which is essential for churches.

In this book you will discover the difference between restricted and unrestricted funds and understand the best methods for tracking funds separately in financial records which is crucial for meeting specific donor restrictions and organizational accountability.

This 14 page ebook covers the following topics:

- The difference between bookkeeping and accounting

- What a "Fund" is and 5 features of fund accounting

- What is "restricted" funds?

- Difference between unrestricted and restricted funds

- 3 reasons to use fund accounting

Also includes a BONUS!

Private links to videos that show step by step how to set up tracking funds in QuickBooks Online.

Included in the Bookkeeping for Churches Package above! However, you can purchase it by itself for only $7.95 by clicking the ADD TO CART button below!

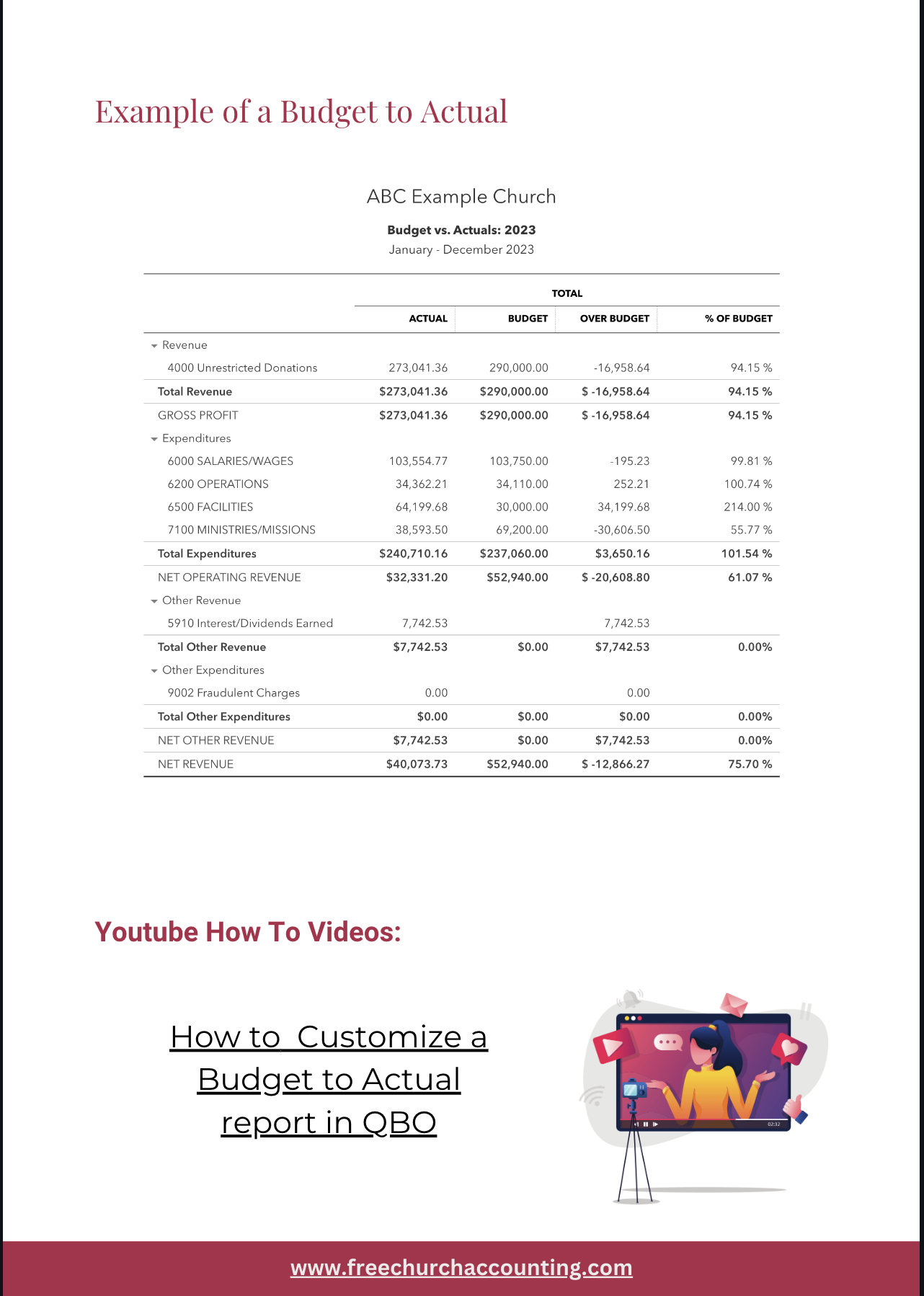

Book 2 in the Bookkeeping for Churches Series:

Accounting Concepts & Financial Statements

Dives into basic accounting concepts such as accounting practices and methods.

This ebook also covers the different financial statements suitable for a church with detailed explanations and examples of each one. Plus which reports are required for nonprofit, but not necessary for a church.

This 25 page ebook covers the following topics:

- Single Vs Double Entry Bookkeeping

- Basic Accounting Concepts

- Explanations of Financial Statements

- Examples of a Statement of Activity (using the traditional fund accounting method and the SAFS method); a Statement of Financial Position (Balance Sheet): a Statement of Cash Flows; and a Budget to Actual report

Also includes a BONUS!

Link to a video that show step by step how to customize a Budget to Actual report in QuickBooks Online Plus and Advanced.

Included in the Bookkeeping for Churches Package above! However, you can purchase it by itself for only $7.95 by clicking the ADD TO CART button below!

Here is what a business teacher said about the accounting ebooks:

"I am a high school business teacher and have been approached by a church secretary to help her with a few accounting issues that she is having at her church. I teach beginning and advance accounting and realized that double entry accounting is quite different from church accounting. I purchased your books. They are wonderful and accurate reading from the accounting point of view."

-W. SPLEEN

Bookkeeping for Churches Package

Included in this package are all 4 ebooks listed below and the Chart of Accounts Template for QBO (details on the Chart of Accounts page)

Bought separately, you would pay $36.80, but for a limited time, you can purchase all 4 eBooks in the Bookkeeping for Churches Package and the COA Template for only $27.60 That's a 25% discount!

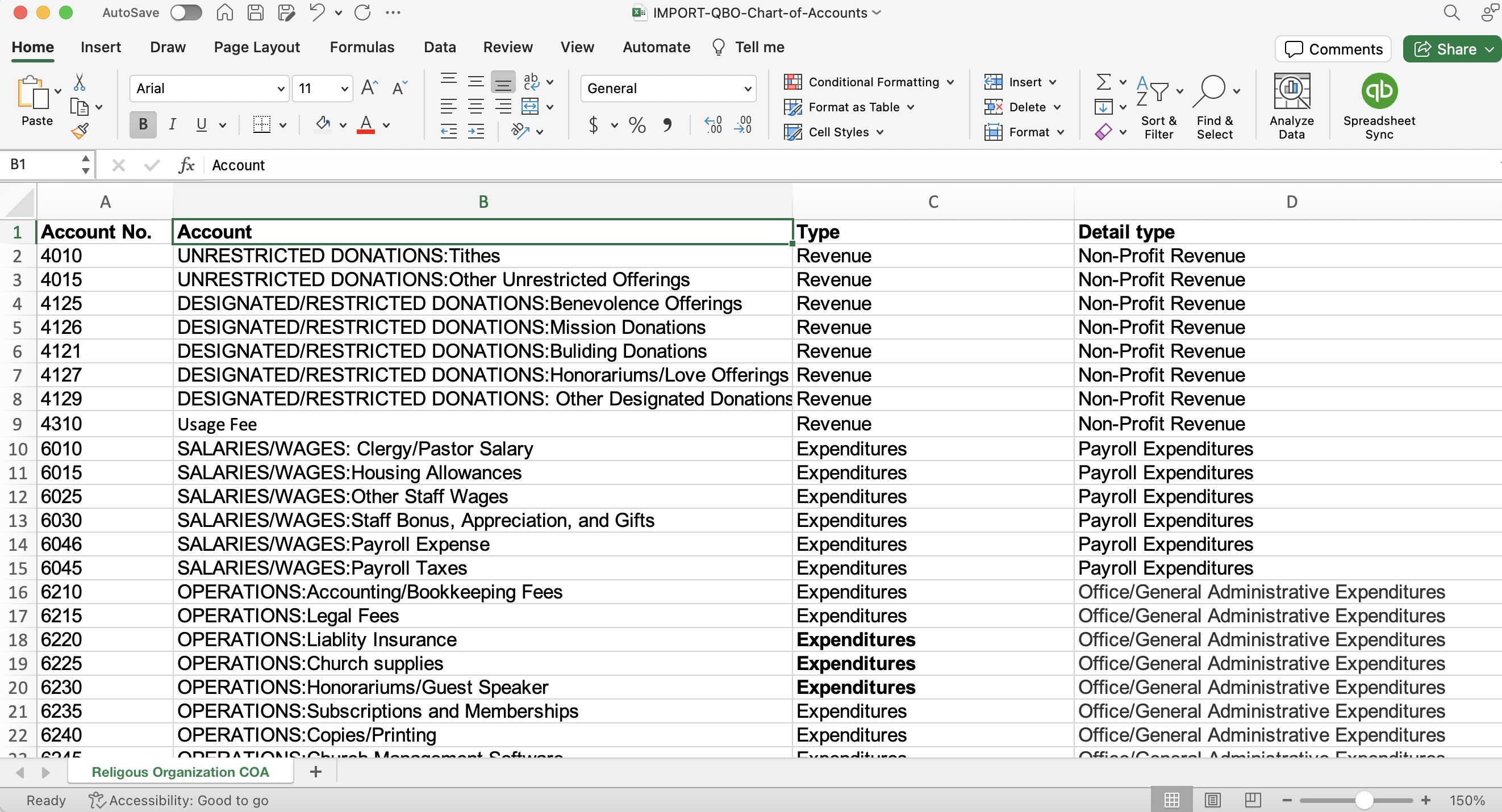

Book 3 in the Bookkeeping for Churches series:

Chart of Accounts

Delves into the components of a chart of accounts and provides guidance on setting it up correctly for a church.

This ebook also explains the three components of an account, guides on when to debit or credit an account in your records, and suggests the most suitable accounting method for a church.

This 18 page ebook covers the following topics:

- Chart of Account Breakdown

- Universal COA Numbering System

- Chart of Account Tips

- Characteristics of an Account

- Understanding Debits Vs Credits

- Accounting Methods

Also includes a BONUS!

The Chart of Accounts importable template for QBO detailed on the Chart of Accounts page

Included in the Bookkeeping for Churches Package above! However, you can purchase it by itself for only $7.95 by clicking the ADD TO CART button below!

Book 4 in the Bookkeeping for Churches Series:

Recording Transactions

Explores the process of recording transactions for a church, including guidance on creating payroll journal entries in a manual system and in accounting software.

The ebook also addresses transferring funds between accounts, identifying and correcting errors, and provides an overview of double-entry bookkeeping.

This 29 page ebook covers the following topics:

- Recording Transactions

- Payroll Accounting and Its Complexities

- Transferring Funds Between Accounts

- Discovery and Rectification of Mistakes

- Double Entry Bookkeeping Overview

Also includes a BONUS!

Link to a video that show step by step how to transfer funds in QuickBooks Online.

Included in the Bookkeeping for Churches Package above! However, you can purchase it by itself for only $7.95 by clicking the ADD TO CART button below!

Bookkeeping for Churches Package

Included in this package are all 4 ebooks listed below and the Chart of Accounts Template for QBO (details on the Chart of Accounts page)

Bought separately, you would pay $36.80, but for a limited time, you can purchase all 4 eBooks in the Bookkeeping for Churches Package and the COA Template for only $27.60 That's a 25% discount!

More Testimonies:

Here is what a church treasurer said:

"As you mention, church accounting is different. I am an Accountant by trade and I find all the information you provide, with regards to handling the books of the church, very very useful. So, thanks again!"

-Pam Caesar

Here is a comment from another church treasurer:

"Thanks Vickey! I purchased your Bookkeeping for Churches ebooks and Accounting Systems and found them helpful. I'm taking over as treasurer for our church and was new to church accounting. Your books were helpful in getting my feet grounded in fund accounting."

-Mike from PA

Here is what a former CPA and Systems Implementation consultant said about this book:

Thanks Vickey. Cool stuff. I just finished reading 'Bookkeeping for Churches' and it is great for the unskilled.

Our small church is suffering under the burden of a robust church accounting package. I'm assisting the Fin. committee (I'm a former CPA and Systems Implementation consultant - now in Seminary pursuing ministry for a second career). As you know, for volunteers who aren't accounting oriented such a robust system can drown them. I'm a big fan of simple, especially with small operations.

Thanks for your passion for this area,

-Jim from FL