Church Accounting Package

Are you feeling overwhelmed?

Don't know where to start to get your nonprofit or church's accounting in order?

In this day and age ... having your accounting set up properly and being IRS compliant is essential.

Coupon!

Here is a 10% discount code for all the ebooks, spreadsheets, and packages on this site:

FCA

Note: click on "PACKAGES" in the top navigation bar for a list of all of the ebook and spreadsheet packages on this site!

The Church Accounting Package will help you do just that!

Before we get into all the Church Accounting Package offers, let me tell you about a very special offer that we have for a limited time!

Church Accounting Package Deal!

Included in this package are the "Bookkeeping for Churches" and "Compensating Ministers" packages listed below.

Bought separately, you would pay $58.65 for both eBook packages, but for a limited time, you can purchase both eBook packages in the Church Accounting Package for only...

$46.90

SAVE even more with this 10% discount code:

FCA

Save even more with the

COMBO ACCOUNTING PACKAGE!

Includes both the Church Accounting Package and the Spreadsheet Package!

Included in this package are 2 ebook packages and the 6 accounting workbooks plus 1 Word document included in the Spreadsheet Package!

Bought separately, you would pay $95.60 for all 3 packages, but for a limited time, you can purchase both eBooks packages in the Church Accounting Package and everything in the Spreadsheet Package in the COMBO PACKAGE for only...

$69.95

That's over a 25% discount!

For a limited time, SAVE even more with this 20% discount code:

SSP20

Bookkeeping for Churches Package:

Book 1: Understanding Fund Accounting

Delves into the ins and outs of fund accounting which is essential for churches.

In this book you will discover the difference between restricted and unrestricted funds and understand the best methods for tracking funds separately in financial records which is crucial for meeting specific donor restrictions and organizational accountability.

This 14 page ebook covers the following topics:

- The difference between bookkeeping and accounting

- What a "Fund" is and 5 features of fund accounting

- What is "restricted" funds?

- Difference between unrestricted and restricted funds

- 3 reasons to use fund accounting

Also includes a BONUS!

Private links to videos that show step by step how to set up tracking funds in QuickBooks Online.

Included in the Bookkeeping for Churches and Church Accounting Package However, you can purchase it by itself for only $7.95 by clicking the ADD TO CART button below!

Book 2: Accounting Concepts & Financial Statements

This 25 page ebook covers the following topics:

- Single Vs Double Entry Bookkeeping

- Basic Accounting Concepts

- Explanations of Financial Statements

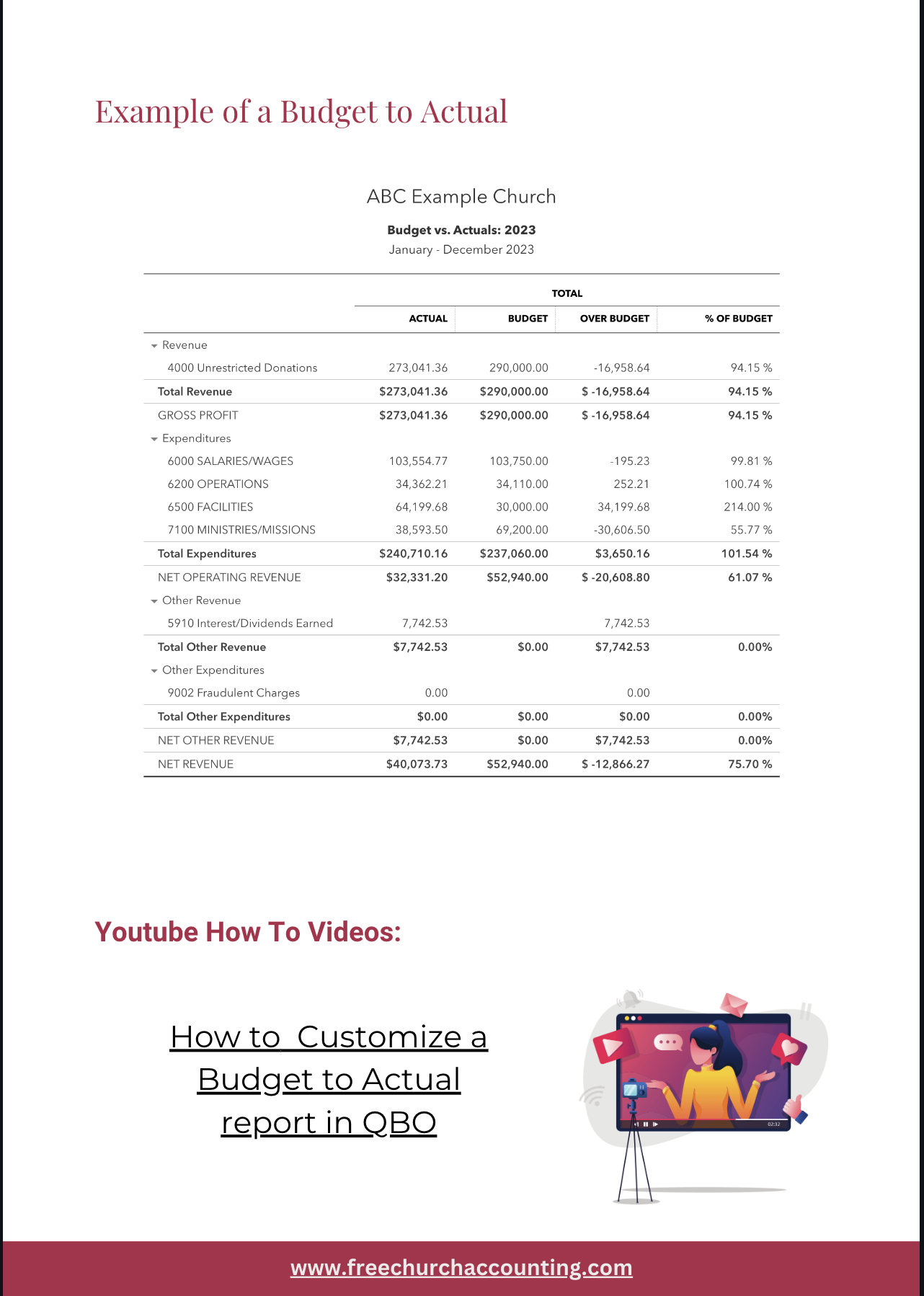

- Examples of a Statement of Activity (using the traditional fund accounting method and the SAFS method); a Statement of Financial Position (Balance Sheet): a Statement of Cash Flows; and a Budget to Actual report

Also includes a BONUS!

Link to a video that show step by step how to customize a Budget to Actual report in QuickBooks Online Plus and Advanced.

Included in the Bookkeeping for Churches, Church Accounting, and Combo Packages. However, you can purchase it by itself for only$7.95 by clicking the ADD TO CART button below!

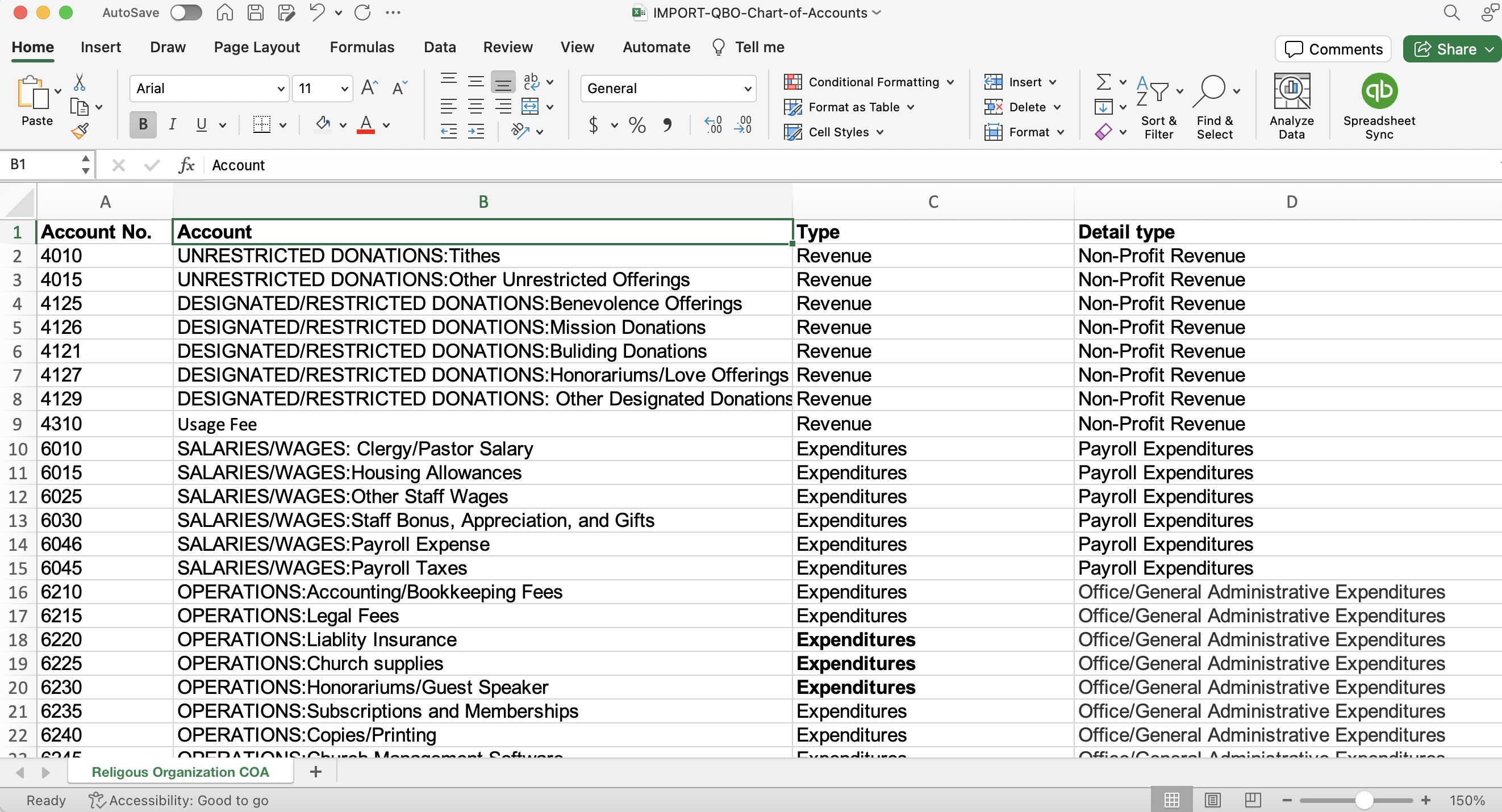

Book 3: Chart of Accounts

This 18 page ebook covers the following topics:

- Chart of Account Breakdown

- Universal COA Numbering System

- Chart of Account Tips

- Characteristics of an Account

- Understanding Debits Vs Credits

- Accounting Methods

Also includes a BONUS!

The Chart of Accounts importable template for QBO detailed on the Chart of Accounts page

Included in the Bookkeeping for Churches, Church Accounting, and Combo Packages. However, you can purchase it by itself for only $7.95 by clicking the ADD TO CART button below!

I am a high school business teacher and have been approached by a church secretary to help her with a few accounting issues that she is having at her church.

I teach beginning and advance accounting and realized that double entry accounting is quite different from church accounting.

I purchased your book and downloaded your spreadsheets. They are wonderful and accurate reading from the accounting point of view.

- W.SPLEEN

Book 4: Recording Transactions

Explores the process of recording transactions for a church, including guidance on creating payroll journal entries in a manual system and in accounting software.

The ebook also addresses transferring funds between accounts, identifying and correcting errors, and provides an overview of double-entry bookkeeping.

This 29 page ebook covers the following topics:

- Recording Transactions

- Payroll Accounting and Its Complexities

- Transferring Funds Between Accounts

- Discovery and Rectification of Mistakes

- Double Entry Bookkeeping Overview

Also includes a BONUS!

Link to a video that show step by step how to transfer funds in QuickBooks Online.

Included in the Bookkeeping for Churches, Church Accounting, and Combo Packages. However, you can purchase it by itself for only $7.95 by clicking the ADD TO CART button below!

Compensating Ministers Package

Book 1: Uniqueness of Paying Ministers

The 28 page eBook"Uniqueness of Paying Ministers" includes:

- Determining who is a minister for tax purposes

- Special tax treatment for ministers

- Paying Social Security and Medicare taxes under the SECA system

- Opting out of social security

- Minister compensation benefits and issues

- Unintentional excessive benefits

Explains the IRS's distinctive classification of ministers, setting up their compensation, considerations before opting out of social security, and potential risks for your church in how you compensate your minister.

Included in this Church Accounting Package, and the Combo Packages. However, you can purchase it by itself for only $7.95 by clicking the ADD TO CART button below!

Book 2: Housing Allowance

The 28 page eBook"Housing Allowance" includes:

- What is a housing allowance?

- Designating, adopting, and recording a housing allowance

- Example of a resolution to officially adopt a housing allowance

- Example of a Estimate worksheet for your minister to use to determine amount of housing allowance

- Examples of eligible and ineligible housing expenses

- Limitations of a housing allowance

- How the church should report a housing allowance

- Example of a Housing Allowance Notification Letter

- Documentation is Key

Covers the definition of a housing allowance, providing guidance on how to establish one effectively and within legal boundaries. It also explains the eligibility criteria, permitted housing expenses for ministers, and the church's reporting obligations. Additionally, it offers examples of a housing allowance resolution, a minister's estimated worksheet, and a notification letter.

Included in this Church Accounting Package, and the Combo Packages. However, you can purchase it by itself for only $7.95 by clicking the ADD TO CART button below!

Book 3: Gifts and Benefits

The 18 page eBook"Gifts and Benefits" includes:

- Gift and love offerings guidelines

- Gifts for guest speakers, singers, and musicians

- Which fringe benefits are taxable and why

- Example of a minister's W-2

Outlines the definition of taxable gifts or love offerings, specifies what should or should not be included in taxable income as fringe benefits, and provides an example of a minister's W-2 form.

Included in this Church Accounting Package, and the Combo Packages. However, you can purchase it by itself for only $5.95 by clicking the ADD TO CART button below!

Very well written. Lots of important information needed with today's changes in rules and laws.

Would highly recommend to others in church administrations.

- B Holland

Church Accounting Package Deal!

Included in this package are the "Bookkeeping for Churches" and "Compensating Ministers" packages listed below.

Bought separately, you would pay $58.65 for both eBook packages, but for a limited time, you can purchase both eBook packages in the Church Accounting Package for only...

$46.90

SAVE even more with this 10% discount code:

FCA

Save even more with the

COMBO ACCOUNTING PACKAGE!

Includes both the Church Accounting Package and the Spreadsheet Package!

Included in this package are 2 ebook packages and the 6 accounting workbooks plus 1 Word document included in the Spreadsheet Package!

Bought separately, you would pay $95.60 for all 3 packages, but for a limited time, you can purchase both eBooks packages in the Church Accounting Package and everything in the Spreadsheet Package in the COMBO PACKAGE for only...

$69.95

That's over a 25% discount!

For a limited time, SAVE even more with this 20% discount code:

SSP20

Our Promise

Your Accounting Package purchase is 100% safe and secure - and 100% risk-free with SendOwl and PayPal.

Your order will be processed in seconds - and then you can download the ebooks and spreadsheets immediately from the web.

You can start reading them today!

Note: If you do not receive an immediate download link with your purchase or if you are having problems with the checkout process, please review this FAQ page or contact me.

The ebooks are in a PDF format so you will be able to read it on a Windows PC, an Apple Mac, iPad, tablet, or some phones simply by using a reader software such as Adobe Acrobat which you can download here or your app store for free.

My Personal Guarantee:

This church accounting package comes with a No-Questions-Asked-30 Day Guarantee: If you're not satisfied with this package, just

contact me

within 30 days of your date of purchase - and I'll issue your 100% refund ASAP.

Testimonies

Would Highly Recommend. Took the mystery out of Church Accounting for me ...more...

Excellent Book! I highly recommend these books. They are a necessity, WRITTEN IN PLAIN ENGLISH!

Errol James

Real Eye Opener. Not knowing a thing about church finances, this was a real eye opener and a great way to get us started ...more...

Very Helpful and Detailed I would recommend these books to everyone, I am from Canada and would also recommend it to all of the Canadian people involved in the Finance part of the church. Very helpful and detailed. A must get!! ...more...

To view more testimonials about the Basic Accounting Books, see the

bottom of this page.

To view more testimonials about the Church Contribution Package, see the

bottom of this page.