Ministers Taxes

Ministers taxes are unique! Because of this uniqueness not all churches understand how to compensate their ministers correctly or how to handle their tax withholding.

This page was designed to help church administrators fully understand a minister's tax status and compensate them accordingly.

Coupon!

Here is a 10% discount code for all the ebooks, spreadsheets, and packages on this site:

FCA

Note: click on "PACKAGES" in the top navigation bar for a list of all of the ebook and spreadsheet packages on this site!

Ministers Taxes Guidelines...

Ministers have "dual status". Most are considered employees of their churches for income tax reporting purposes and all are considered self-employed for Social Security purposes.

Because of this special tax treatment it is imperative that church administrators know the IRS's tax laws regarding clergy or ministers taxes.

Such as the fact that a church can withhold income tax (at the minister requests), but not Social Security and Medicare tax.

A minister pays the Social Security and Medicare tax himself under the SECA system. He can pay this tax by making quarterly estimated tax payments, or by requesting the church to hold out extra income tax.

Ministers can also "opt out" of paying in Social Security...if certain conditions are met.

Ministers are also usually eligible for a housing allowance which can be a great tax benefit for ministers...if set up and maintained properly.

There are even situations where it is not only allowable but beneficial for the church to designate 100% of a minister's compensation as a housing allowance.

Learn all this and more regarding ministers taxes by reading the articles below...

Learn more...

Minister taxes raises some interesting questions for the church such as what should be withheld from their pay and what is the church's responsibilities ...

Church Accounting Package

A set of 2 ebook packages that covers the following topics...

- Fund accounting examples and explanations

- Difference between unrestricted and restricted funds

- Best methods for tracking restrictive funds

- Explanations and examples of financial statements for churches and nonprofits

- Minister compensation and taxes

- Payroll accounting and its complexities

- Much more - Click here for details

A housing allowance is one of the greatest tax benefit available to ministers. It is also one of the least understood ...

Designating all salary as housing allowance? Is it legal? It is advisable? ...

The Compensating Ministers Package includes three ebooks on how to compensate and pay your ministers; what minister benefits could potentially hurt the minister and the church; how to set up a housing allowance and report it; and how to handle ministers' gifts/love offerings. Also includes an example of a W-2 for a minister.

Additionally there is a sample of a resolution you can use to to set up and approve a housing allowance for your ministers; an estimate worksheet for the minister to use to help the church determine the amount of the housing allowance; and an example of a notification letter the church can use to inform the minister on the amount of housing allowance payments paid during a calendar year.

All 3 ebooks are only $18.55 PLUS you can use the discount code: FCA for an additional 10% off!

Figuring your fair rental value (FRV) is an essential part of claiming a housing allowance.

Plus...ministers that live in a church provide parsonage must know how to determine the FRV of the parsonage, as they are required to add in the FRV of the parsonage when figuring their self-employment tax...

A designated housing allowance for evangelists can be part of a guest speaker’s compensation. It should be designated in advance and handled correctly, but can be a nice tax benefit for your traveling evangelists ...

Housing Allowance for EvangelistsLove offerings (gifts) are complex issues for church administrators. See some guidelines in handling love offerings...

Tips on paying your pastor or minister such as whether to issue a W-2 or 1099 and the legality of paying them a percentage of a church's income ...

Conditions that must be met before a minister is permitted to opt out of social security ...

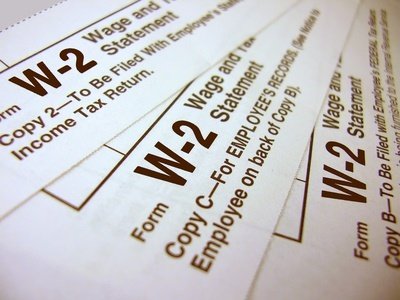

Majority of the time, pastors/ministers are considered an employee of their church and should be issued a W-2 to report their compensation...

See an Example of a Pastors W-2