Are You Feeling Overwhelmed?

Need help doing the accounting for your church or nonprofit?

You are at the right place!

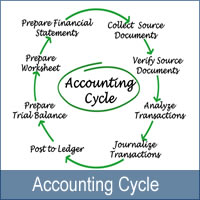

This site and the topics covered (see below) will help you take out the mystery and bust the myths of Church accounting and nonprofit accounting. The materials are based on accounting best practices, facts and federal tax codes that are specific to small churches and nonprofit organizations.

This site is a great place to start for those with little or no accounting knowledge and for those with experience who may want a refresher as finance laws continue to change.

Whatever experience you have, the congregation expects the treasurer to "take care" of the finances of the church. But many churches are not aware of the complex finance issues, what actions need to occur to be compliant and documentation needed to lessen liability for the church and protect its’ congregation, pastor and staff.

Coupon!

Here is a 10% discount code for all the ebooks, spreadsheets, and packages on this site:

FCA

Note: click on "PACKAGES" in the top navigation bar for a list of all of the ebook and spreadsheet packages on this site!

Topics Covered on this Site:

Built From Real Experience:

Many years ago to assist our church's secretary, I created easy to use accounting workbooks and spreadsheets. She loved them and told several other church secretaries and treasurers about them. They got hold of me and asked if they could use them for their churches. They also wanted additional pointers on setting up a good accounting system and other church accounting issues.

Even with a seasoned accounting background...church and nonprofit accounting was different from commercial accounting and sadly there wasn't much on the internet about the basics of church accounting at that time. And this site was born. It gave me an opportunity to share my knowledge of church and nonprofit accounting, resources, tools and my accounting spreadsheets as well. Who would have ever imagined this site would expand to include over 1500 pages, reader posts and comments!

Free Accounting Software:

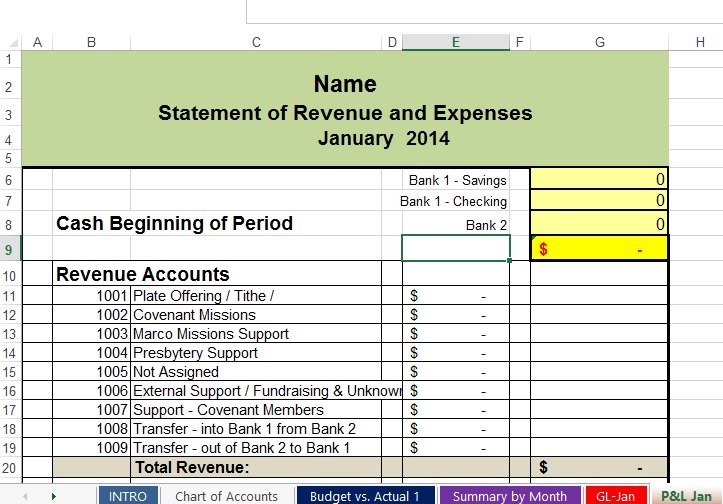

The nonprofit accounting spreadsheets offered free on this site are easy to use and work well for small or start up churches or nonprofits. However, please be aware that they are they are a single entry bookkeeping system (see the difference between single and double entry systems), they cannot track your assets and liabilities and cannot generate a balance sheet. A Balance Sheet has to be created separately; however, there are tons of balance sheet templates free on the internet =)

In the past, there was a requirement in place to sign up for this site's free newsletter, so you could be notified of any errors or updates to the accounting workbooks. That is not the case now and there is a direct link to download the free accounting spreadsheets on this page:

Free Accounting Spreadsheets

Recent Articles

-

NO TAXABLE INCOME

Feb 14, 25 07:38 AM

Our small church is only paying our retired pastor for reimbursable expenses & a housing allowance. If we are not paying him any taxable income, do we -

Pastor housing stipend reporting

Feb 06, 25 03:15 PM

We are a small church and pay our pastor a housing stipend monthly. We've been taxing this payment. How do we report on the W2? -

How to calculate when NOT to take a housing allowance?

Jan 27, 25 06:46 PM

I've heard a few experienced ministers and ordained ministry leaders say that there are times when it costs more in taxes to claim a housing allowance