Step-by-Step Payroll Guide

See a step-by-step payroll guide below.

Payroll can be a daunting task for volunteers and paid staff of small churches and nonprofits. There are so many changing laws that keeping up with them all can be almost impossible.

Coupon!

Here is a 10% discount code for all the ebooks, spreadsheets, and packages on this site:

FCA

Note: click on "PACKAGES" in the top navigation bar for a list of all of the ebook and spreadsheet packages on this site!

Step-by-step payroll tips:

So if you have nonminister employees, I urge you to hire a payroll service or CPA/bookkeeping firm familiar with nonprofits or churches. Note:I has discovered that many payroll services DO NOT know how to set up payroll for ministers! Unless you know all the ins and outs of minister's compensation and can make sure they do it right...get a knowledgeable professional to at least ensure it is set up correctly in the beginning and save yourself some heartache in the future!

I can highly recommend Patriot Payroll software! It is what I use for all of my clients. Their support is awesome! They are very reasonably priced as well. However, for non-accountants and anyone wanting a really easy to use payroll software...I can also recommend Gusto. Several of my clients use it and love it!

However, even if you use a payroll service, you need to know how to properly set up your payroll as your organization will be held responsible for any penalties that may incur from incorrect filings. If you only have a minister employee you may be able to handle it without one of the above mentioned services...especially if their compensation is designated all housing allowance.

The key is setting up a payroll system that complies with all applicable federal and state laws.

First and most importantly...make sure you classify your workers correctly! See this page on Misclassification of Workers

As stated above, if you only have a minister as an employee, you may be able to set up and administer their payroll easily...if you understand the specific laws on ministers.

See this page on clergy taxes to learn more about minister's dual status when it comes to the IRS: Clergy Tax

No matter if you have minister and/or nonminister employees there are some forms you MUST have on file and some steps you should take before issuing that first paycheck.

The Church Accounting: How To Guide devotes a whole section of the book to payroll for churches. It covers payroll terminology and forms and then takes you through the steps necessary to set up a payroll, calculate and file the necessary taxes and forms, and even details how to handle the minister's payroll. It also includes sections on filling out IRS forms: 1099-Misc, 1099-NEC, and 1096.

If you have QuickBooks or are considering using it in the future, go ahead and purchase the QuickBooks for Churches and the How To Guide combo for a complete package on setting up and administering a payroll using QuickBooks.

Step-by-step payroll guide to get you started...

Step One: If you do not already have an Employer Identification Number (EIN), you will need to apply for a number by filling out

IRS Form SS-4.

You can get the number immediately, either by phone or online.

Step Two: Get state and local identification numbers if

they are required in your area. Contact your state revenue department

directly for information on applying to be a payroll provider in your

state. FIND out what churches are exempt from and what they are not!

Step Three: Determine who is an independent contractors and who is a full time employee.

You don't have to withhold taxes from an

indepen dent contractor's pay;

however, please don't think that you can save yourself some trouble by

classifying all of your employees as independent contractors.

The IRS may penalize your Church heavily if you designate regular workers as independent contractors. For details, see the IRS Publication 15, also known as Circular E, The Employer's Tax Guide.

Step Four: Determine a pay period. Your Church is entitled to pay based on any schedule you want; however, most states require you to pay your employees on regular paydays.

Typically Churches pay weekly, bi-weekly, semi-monthly, or monthly. A few states allow some employees to be paid once a month, but most require that you pay your employees at least twice a month. Check with your state department of labor for your state's specific guidelines.

Church Accounting Package

A set of 2 ebook packages that covers the following topics...

- Fund accounting examples and explanations

- Difference between unrestricted and restricted funds

- Best methods for tracking restrictive funds

- Explanations and examples of financial statements for churches and nonprofits

- Minister compensation and taxes

- Payroll accounting and its complexities

- Much more - Click here for details

Step-by-step payroll forms ...

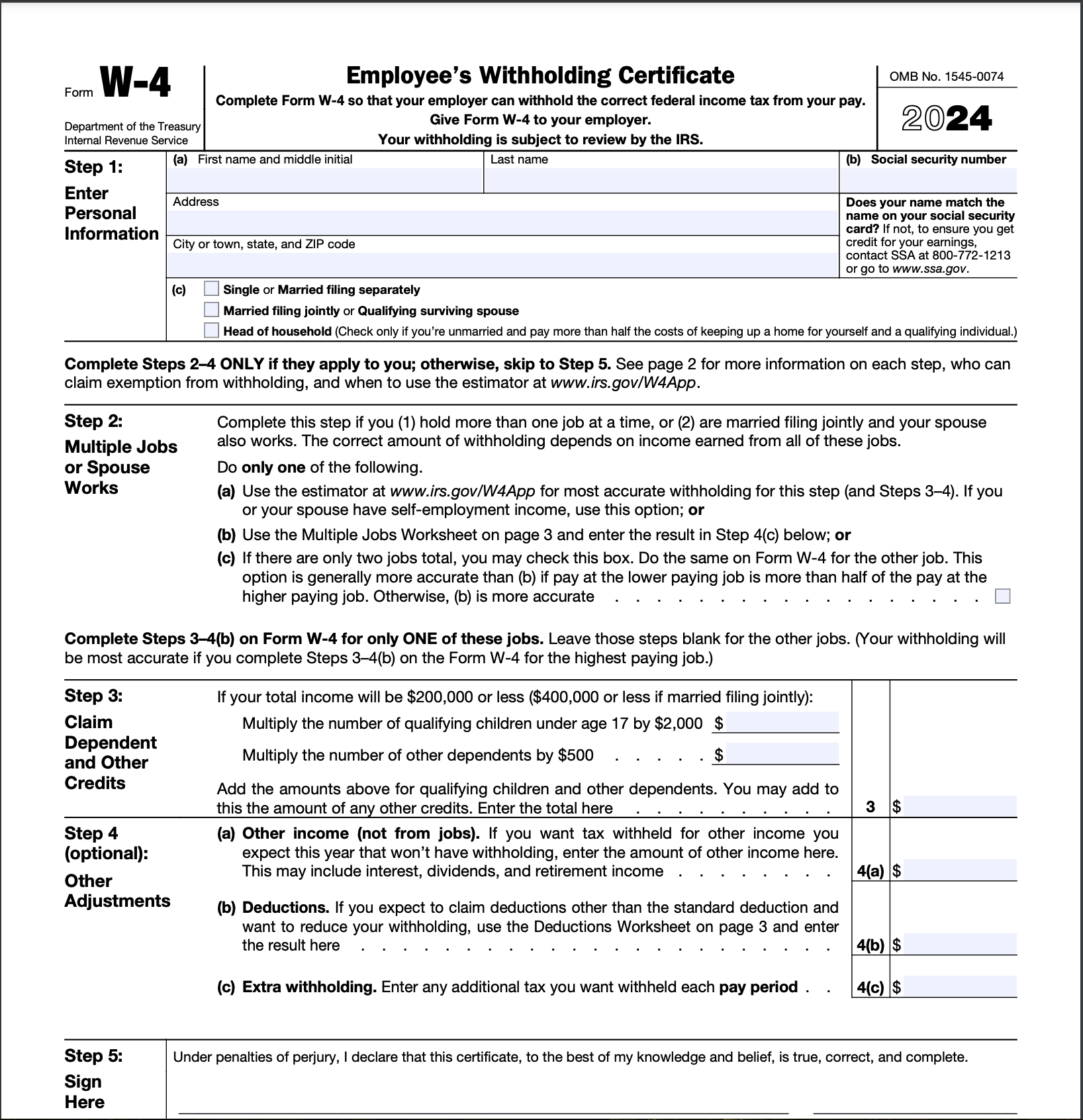

Step Five: Have each employee fill out and sign an

IRS Form W-4 ad I9.

The W-4 form provides four critical pieces of information:

- the employee's Social Security Number

- Name and address

- Their filing status

- Dependents and other credits

Notice: Any time your employees marry or divorce, have children, gain or lose a dependent or want to change withholding amounts for any other reasons, they will need to complete and sign a new W-4.

Also, you are required by law to treat an employee as a single person with no exemptions for withholding purposes, if you do not have an employee's W-4 on file.

So make very sure you have a W-4 in your Church files for each of your employees.

Note: Most states have their own exemption certificate form, so check with your state's tax and labor laws.

Another form you MUST have on file for every employee is a Form I-9.

Form

I-9 is used for verifying the identity and employment authorization of

individuals hired for employment in the United States. All U.S.

employers must ensure proper completion of Form I-9 for each individual

they hire for employment in the United States. This includes citizens

and noncitizens. Both employees and employers (or authorized

representatives of the employer) must complete the form.

Employers must have a completed Form I-9 on file for each person on their payroll who is required to complete the form. Form I-9 must be retained and stored by the employer either for three years after the date of hire or for one year after employment is terminated, whichever is later.

The Compensating Ministers Package includes three ebooks on how to compensate and pay your ministers; what minister benefits could potentially hurt the minister and the church; how to set up a housing allowance and report it; and how to handle ministers' gifts/love offerings. Also includes an example of a W-2 for a minister.

Additionally there is a sample of a resolution you can use to to set up and approve a housing allowance for your ministers; an estimate worksheet for the minister to use to help the church determine the amount of the housing allowance; and an example of a notification letter the church can use to inform the minister on the amount of housing allowance payments paid during a calendar year.

All 3 ebooks are only $18.55 PLUS you can use the discount code: FCA for an additional 10% off!

Step-by-step payroll essentials ...

Step Six: Do report new hires! In accordance with the Personal Responsibility and Work Opportunity Reconciliation Act of 1996 (PRWORA)

ALL EMPLOYERS MUST REPORT ALL NEW HIRES...to

their state(s) within 20 days or sooner depending on the state's

requirement. Check your state's designated state agency for more details and ensure that the payroll tax obligation pertains to churches and

nonprofits.

Step Seven: Do establish payroll records. For federal tax purposes, you must keep the following information on file:

- the name, address and Social Security Number of each employee

- the total amount and date of each payment

- the portion of each payment that constituted taxable wages

- copies of each employee's W-4

- copies of returns you filed

- copies of any undeliverable W-2 forms

Step Eight: Do calculate payroll taxes and withholding. For income tax purposes the federal government provides tax tables (IRS’s Circular E) that calculate the amount you must withhold once you have established the appropriate amount of taxable wages.

Also most of your state and local governments require withholding too, so be sure you request a similar payroll tax publication from them (most have them online).

All states except Alaska, Florida, Nevada, New Hampshire, South Dakota, Tennessee, Texas, Washington and Wyoming impose a personal income tax.

Some employees may ask you to withhold an extra amount, especially your ministers as they are required to pay their own self employment tax. (see the clergy tax page). Have them put the extra amount they want withheld from each paycheck on Step 4c in their W-4.

For all employees, except ministers, you will be matching and withholding FICA tax unless your church has exempted itself from making these payments by filing an IRS Form 8274, Certification by Churches and Qualified Church-Controlled

Organizations Electing Exemption from Employer Social Security and

Medicare Taxes.

Remember, you will not be matching or withholding FICA taxes on qualifying ministers as they are considered by the IRS to have a dual status.

“Dual Status” means a minister is considered an employee for federal income tax purposes and self-employed for Social Security and Medicare purposes.

Also, churches are exempt from FUTA (federal unemployment taxes). Many states also grant exemption to churches from state unemployment taxes.

Consult the state unemployment tax agency for your particular state to make sure your state grants an exemption to churches.

Note: Most states require churches to provide Workers’ Compensation. Please check with your state to see if your church or nonprofit organization is required to provide this coverage.

There are also a few states that require you withhold and/or pay taxes that fund the state's temporary disability insurance program.

If you live in California, Hawaii, New Jersey, New York, Rhode Island,

or Puerto Rico contact your state's appropriate agency to see if this

applies to your church or nonprofit.

Step Nine: Prepare and file payroll tax returns. The IRS requires that you file a quarterly Form 941, reconciling the amount of tax you owe and the amount you have paid.

This form is due by the end of April for the first quarter’s payroll

taxes, end of July (2nd Q), end of October (3rdQ), and by the end of

January for the fourth quarter’s payroll tax.

Most states have their own payroll tax forms due in the same month as the form 941s. Check with your state for the appropriate forms and due dates.

Step Ten: Prepare annual W-2 forms

each January for all of your employees, showing how much they were paid

and summarizing their withholding for the previous year. These forms

are filed with the Social Security Administration and copies are sent to

your employees.

See this page for more information on preparing and filing W-2s and a W-3.

I hope this step by step payroll for churches has helped you. We are in the process of producing videos for more information on setting up and recording payroll for churches on our YouTube channel: Free Church Accounting

Please subscribe to our channel and let me know in the comments what subjects you would like me to talk about.

Note: I am a Partner of both payroll software and will receive a small commission if you decide to use Patriot and go thru the link above (they stopped my commission last year ...but they are still awesome payroll software and I still recommend them). With Gusto, you and I could both get a gift card. BUT as I have told you before, I will never recommend ANY software that I have not used and/or have not had a positive experience with =)