QuickBooks for Churches

Accounting Software for Churches and Nonprofits

I love QuickBooks Online (QBO)! I use it for my bookkeeping business and it does everything I need and more.

I have set up more churches than I can count in QBO and have found it works well for them as well...with a little adjustments.

Coupon!

Here is a 10% discount code for all the ebooks, spreadsheets, and packages on this site:

FCA

Note: click on "PACKAGES" in the top navigation bar for a list of all of the ebook and spreadsheet packages on this site!

A must have for everyone that has or is thinking of running QuickBooks for their church. Walks you through QBDT or QBO from start to finish, complete with examples, terminology, and everything a busy church administrator or bookkeeper needs to know.

For the Desktop QB: Click here for more details!

For QuickBooks Online (QBO): Click here for more details!

~Attention: Use Coupon Code: "FCA" for a 10% Discount!

Using QuickBooks for Churches and Nonprofits:

Let me lay a little ground work here first...

If you are a start up church or a small church...without many assets and liabilities...

single entry bookkeeping...such as my accounting spreadsheets may work fine for you.

However, double entry bookkeeping is always the best option...if possible. See this page on basic accounting for the difference between single and double entry bookkeeping.

For those who do have it in their budget for accounting software, I recommend doing some extensive research before choosing your software.

See this page for some tips to help you decide which software is the best accounting software for your church or nonprofit.

One of the best incentives for using QBO or QB Desktop is TechSoup and Intuit's "almost" free offer! Click on the link in the box below for more details...

Intuit has an offer for eligible charities. See more on this QB Offer.

Like I stated above...I have set up many churches in the online version of QuickBooks and like the extensive reporting capabilities among other things with QB desktop and online software.

Finally!!!

Courses Created Specifically for Churches Using QuickBooks!

There are TONS of videos available on the web for using QuickBooks BUT not very many "accurate" videos on using QB for churches...especially with QBO!

So I am very excited to tell you about these online classes that were created exclusively for all of us that use the desktop and online version of QuickBooks!

Lisa London of "The Accountant Beside You" has created a series of online courses using step-by-step videos to show you how to use QuickBooks "effectively" for your nonprofit or church...

The courses include:

The Nuts and Bolts - learn how you can take QuickBooks for a test drive, set it up, and the how to use it effectively! Available for QuickBooks Online and QuickBooks Desktop.

Advanced Topics -learn budgeting, report and correspondence customizations, handling special events and capital campaigns, and so much more.

Common Mistakes and How to Correct Them -correct set up errors, bank and credit card reconciliation issues, donations errors, reclassifications and more.

Save with a 10% discount on ALL CLASSES!

Use coupon code: FCA

Let's start with the desktop version:

Features I like with QuickBooks Desktop:

- One time purchase and it's yours! (Update: you can now get the Nonprofit desktop version or the online QB almost free of charge through Techsoup! See more on that offer here!)

- QB Centers along with icons make it easy to access frequently used functions

- Can password protect it

- Handles bills, payments, and bank reconciliation easily

- Great budgeting tools

- Computes and processes payroll and its taxes...for an additional cost (Note: I can not recommend using Intuit's Payroll as I personally have had too many bad experiences with them)

- Prints Checks

- Compatible with Microsoft Office (Word, Excel, Outlook, etc)

- There are more reports you can create in the desktop than the online version.

- You can track donors easier in the desktop version.

Features available in the Nonprofit Edition:

- Tracking donors and contributions

- Creating personalized letters and envelopes for donors

- Tracking budgets and finances by program

- Preparing IRS Form 990 or Form 990-EZ

- Creating other reports specifically for non-profits

- Can create a Statement of Financial Position (Balance Sheet) by class (funds)

QuickBooks® Online or desktop? How are you to know which version would work best for your small nonprofit or church's specific needs?

That depends on who you ask =) They both have pros and cons. See Lisa London's article on deciding which version may work best for your organization: QuickBooks Online or Desktop?

So in a nutshell...

1. QBDT (QuickBooks Desktop) (Nonprofit and Pro) works best for churches and non-profit organizations with operating budgets of all sizes ....even those with an operating budget of $1 million plus. However, I strongly suggest either hiring someone very familiar with setting up churches or nonprofits in this "off the shelf" accounting software OR purchasing Lisa London's 3 Online Course Bundle (more information below on the classes) BEFORE setting up and using this desktop software...even with the Nonprofit Edition!

I have seen too many "messed up" QB files that caused a lot of problems and stress for the users....some were even set up by CPA firms that were just not familiar enough with church accounting to set up an "effective, easy to use" QB file.

So if you decide to use QBDT or QBO, do at least one of the following:

- Find a CPA that KNOWS how to set up QB for a church (ask for references!)

- Purchase and USE Lisa London's hundreds of short online videos and PDFs in her online classes that show you how to set up the file properly for a church or nonprofit and HOW TO use it efficiently!

- At the very least...purchase her book "Quickbooks for Churches". She will show you how to set up and use QB in her book too...but I have found the online courses with the lifetime access are the best...especially for visual learners.

Something to keep in mind with the desktop version is the importance to keep a backup copy "off site" in case the file gets corrupted or the computer it is on crashes.

Which brings me to the QuickBooks software I prefer: QuickBooks Online!

The Policies and Procedures Package includes an ebook on budgets and audits. It includes details on the different types and categories of budgets and budget tips.

This ebook is included in the Policies and Procedures Package. However, you can purchase it by itself for only $7.95 by clicking the ADD TO CART button below!

The Audits, Budgets, and More ebook is also part of a larger "Policies and Procedures" Package" that is packed full of valuable information and for a limited time you can purchase all 5 ebooks and 8 policy templates for only $32.80

Features I like with QuickBooks Online:

- Web based so more than one person can use it at the same time

- In the "cloud" ...you don't have to worry about "backing it up"

- Tons of "How To" videos available for the basics ...but not many specified for churches...such as how to track a grant?

- Great reporting capability...even though there are not as many reports as the desktop version, the reports in QBO are easy to create and modify

- Ability to create a "report package" with the click of a button which includes a cover sheet

- Connects with a LOT of apps!

- Can connect to almost any bank and credit card and roll in transactions for easy importing. (Let me state here that even though I love the bank integration...I always manually add paper checks and then "match" them in the bank feed...so I can properly track outstanding checks)

Now let me tell you what I do not like about QBO.

I don't like tracking donors/donations in it. It can be done, but it gets time consuming with entering EACH donation as a Sales Receipt.

I always suggest my clients use a great online donation tracking software such as Breeze or Planning Center that tracks off-line giving and well as online. Then I just split the deposits in QBO using the designation reports from those software.

To sum it all up... I believe QBDT and QBO can be affordable options for many churches and nonprofits. Once it is set up PROPERLY -- volunteers with little or no accounting knowledge can easily use it.

The difficult part is setting it up correctly. If your church can afford it, I highly recommend using someone that is very familiar in church or nonprofit accounting to set it up for you AND train you how to use it effectively. That way it will be done correctly and saves possible headaches down the road.

However, if hiring someone to set up your QB or QBO is not an option due to a limited budget. There is still a way for you to set it up and enjoy all the benefits of this very effective accounting software...

Purchase Lisa London's QuickBooks for Churches. Lisa is a CPA and has written this book that is a must for anyone setting up or even maintaining a QB file for churches.

Lisa will walk you through DESKTOP QuickBooks from start to finish, complete with examples, terminology, and everything a busy church administrator or bookkeeper needs to know.

The book is written for beginner and advanced church bookkeepers alike, in a friendly and easy-to-understand style. It includes:

- Step-by-step instructions on how to set up QuickBooks and utilize it more efficiently for your church

- Valuable tips on how to make QuickBooks work better for churches, both large and small

- Numerous illustrative screenshots and time-saving shortcuts

Donation Guidelines Package

A set of 4 ebook packages that covers many of the following topics...

- How to handle and receipt stock donations

- How to handle free rent and labor donations

- How to handle non-cash contributions

- What to do if you receive a DAF (donor advised fund) contribution or grant

- How to handle Quid Pro Quo donations and other fundraising income such as drawings and raffles

- Donation policies and procedures

- Much more - Click here for details

QuickBooks Online® for Churches and Not-for-Profit Organizations

This book contains hundreds of screenshots that helps you set up and use QuickBooks Online (QBO) effectively.

Topics include:

- Procedures to guard against theft and errors

- Designing a chart of accounts (with examples for different types of nonprofits in the appendix)

- Converting a desktop QB organization into QBO

- Tracking donor gifts and grants

- Importing donor and vendor contact information

- Receiving money, paying bills, and tracking credit card charges

- Reconciling accounts

- Budgeting

- Designing management reports

- Month-end and Year-end procedures

- Tracking fundraisers, in-kind donations, volunteer hours

- And so much more!

Note: FreeChurchAccounting readers can enjoy a 10% discount by using the code: "FCA" on all FreeChurchAccounting products and Accountant Beside You products!

Church Accounting Package

A set of 2 ebook packages that covers the following topics...

- Fund accounting examples and explanations

- Difference between unrestricted and restricted funds

- Best methods for tracking restrictive funds

- Explanations and examples of financial statements for churches and nonprofits

- Minister compensation and taxes

- Payroll accounting and its complexities

- Much more - Click here for details

QBO Tips and Comments...

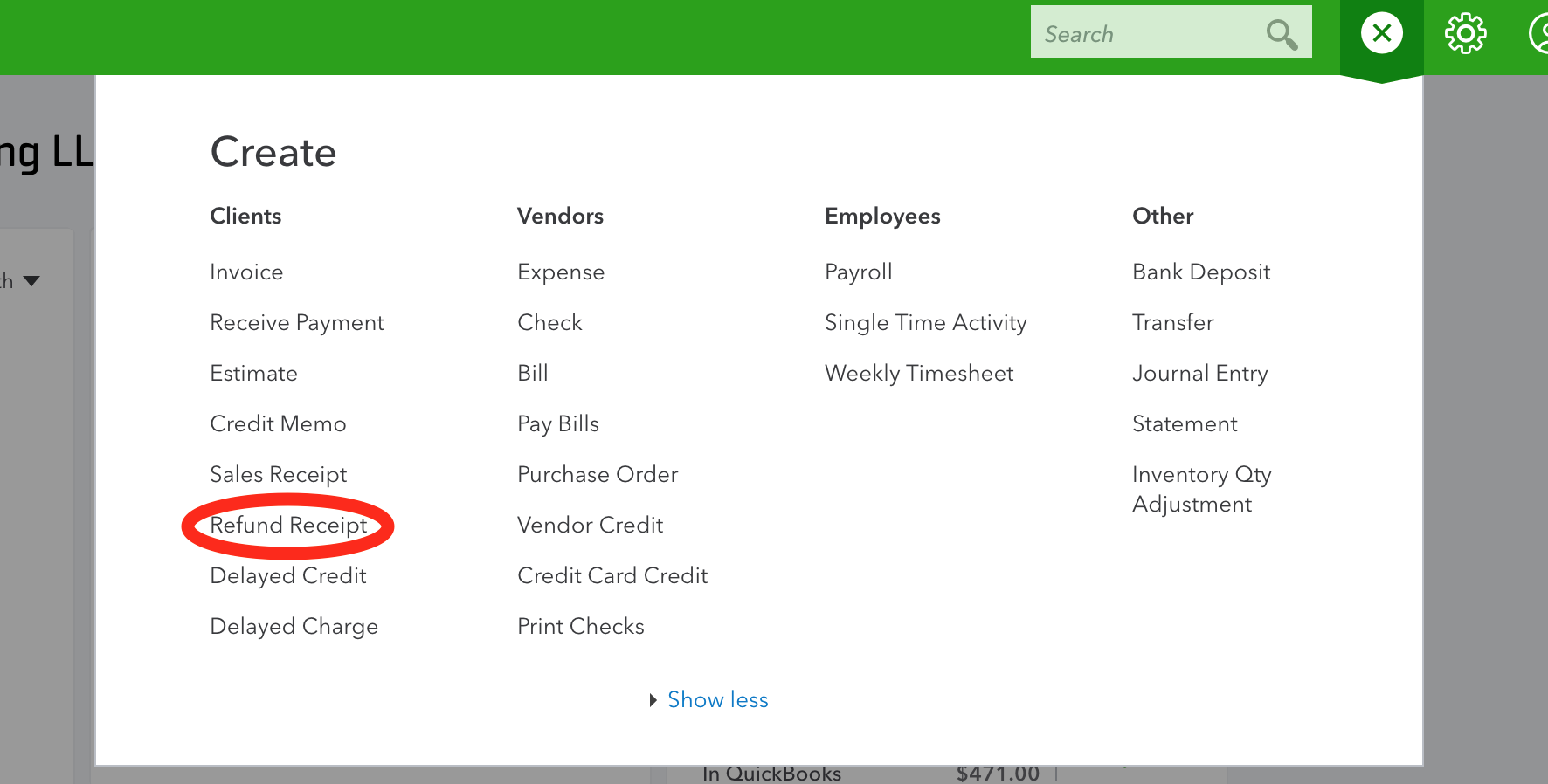

Handling a Bounced Donor Check

I had a client that sent thru a donor's check twice and it bounced both times. They requested that I deduct the amount from the donor's giving record (they were not going to try to deposit it again, nor were they going to attempt to collect the amount from the donor) and properly handle all of the transactions that occurred with the event.

This is how you take that donation back out of the donor's giving record and handle the returned check:

Go to the Quick Create (Plus Sign) ----> CLIENTS ---> Refund Receipt.

Choose

- the donor whose check bounced.

- the date that you want the donation deducted off the donor's giving record.

- the church/nonprofit bank account the check was deposited and returned for NSF (insufficient funds).

- the Product/Service that was chosen for the original donation (we need to deduct that amount from that income account)

- the amount of the bounced check

If you are rolling in your bank transactions, you will simply match the above transaction to the returned check. You can assign the returned check charge (if applicable) to Bank Fees/Charges.

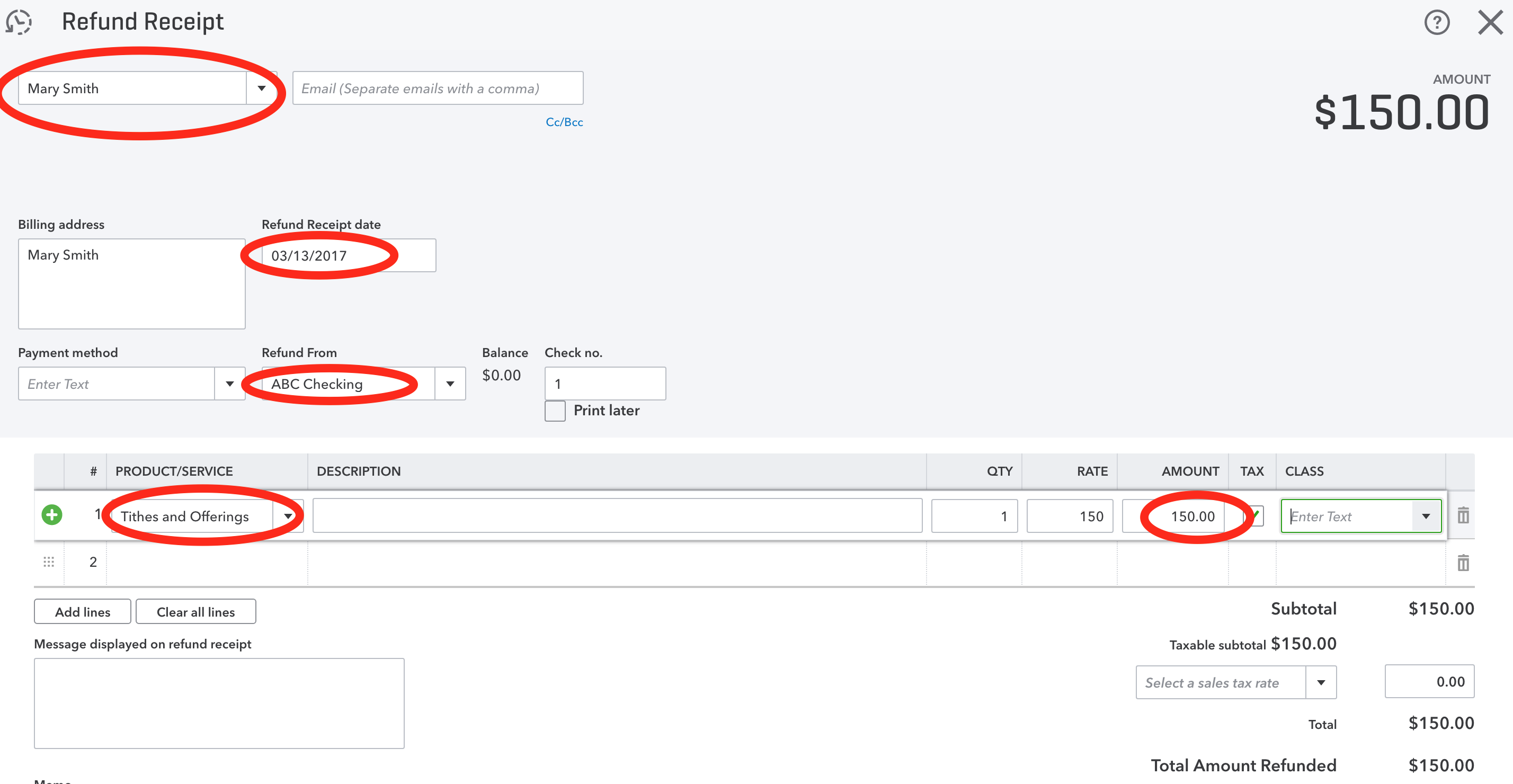

Accounting for Online Donations on QuickBooks Online

I don't like tracking donations in QBO. I would rather use donation tracking software outside of QBO and just properly assign the deposits in QBO.

However, if you track and record donations in QBO, you must record the full donation and give the donor full credit for their donations...even though your online payment processor may take a processing fee out before depositing it into your bank account.

Here is a way to do that...

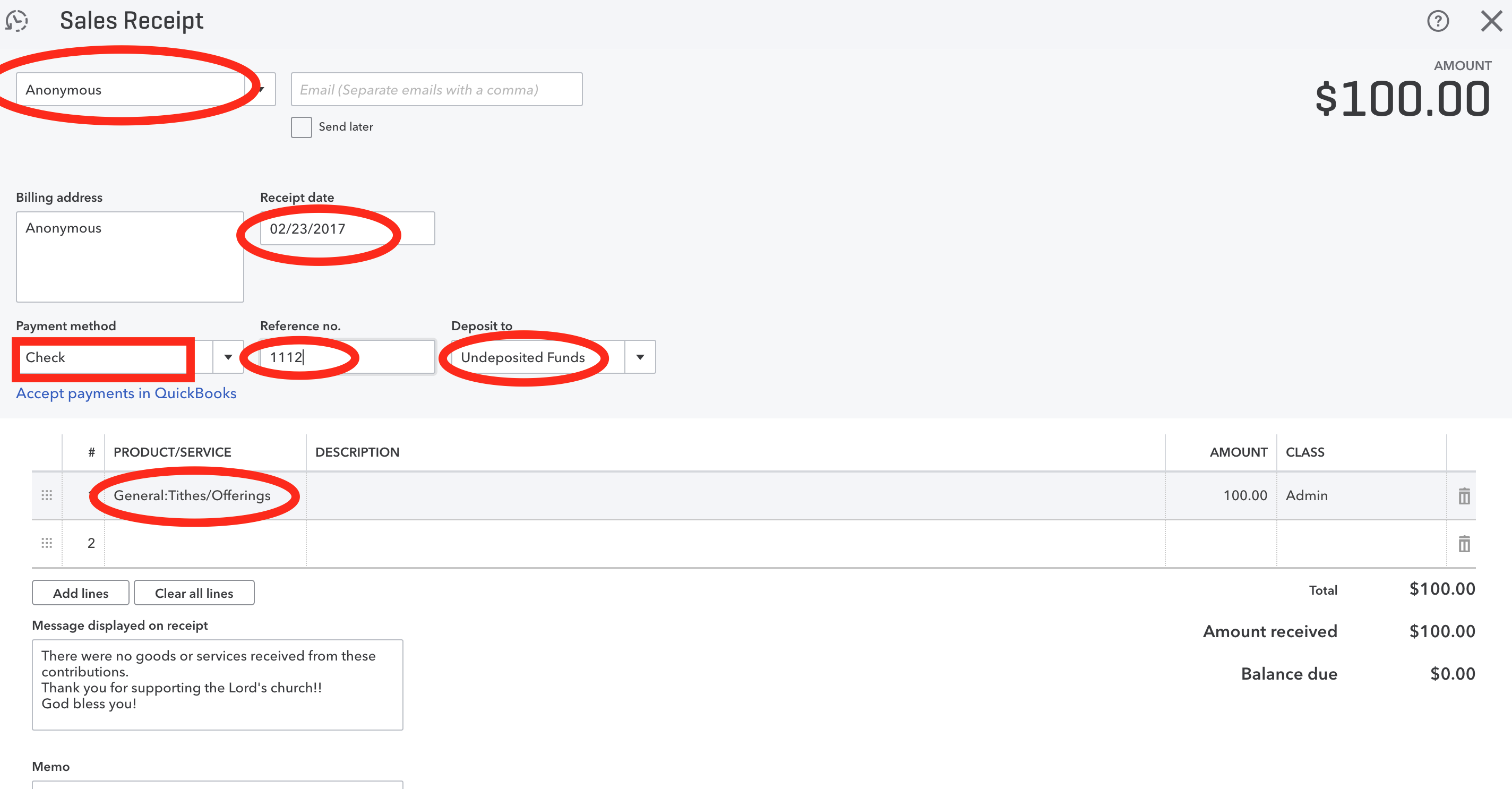

Record the full donation in a Sales Receipt.

Click the Quick Create Button (see image above). Click Sales Receipt. Enter the full donation...

1. Enter the donor's name (if it is a new donor ... click Add and add their information in "Details")

2. Enter the date of the online donation.

3. On Payment method...I Add "EFT"...but you can name it what you want or leave it blank.

4. On Reference no. I usually add the transaction ID from the online processor.

5. Make sure you deposit to: "Undeposited Funds"!

6. Choose your Product/Service

7. Enter the full donation amount and class ... if using classes to track designated funds.

8. Click Save and New if you have more donations to enter or Save and Close if you don't have any more donations to add.

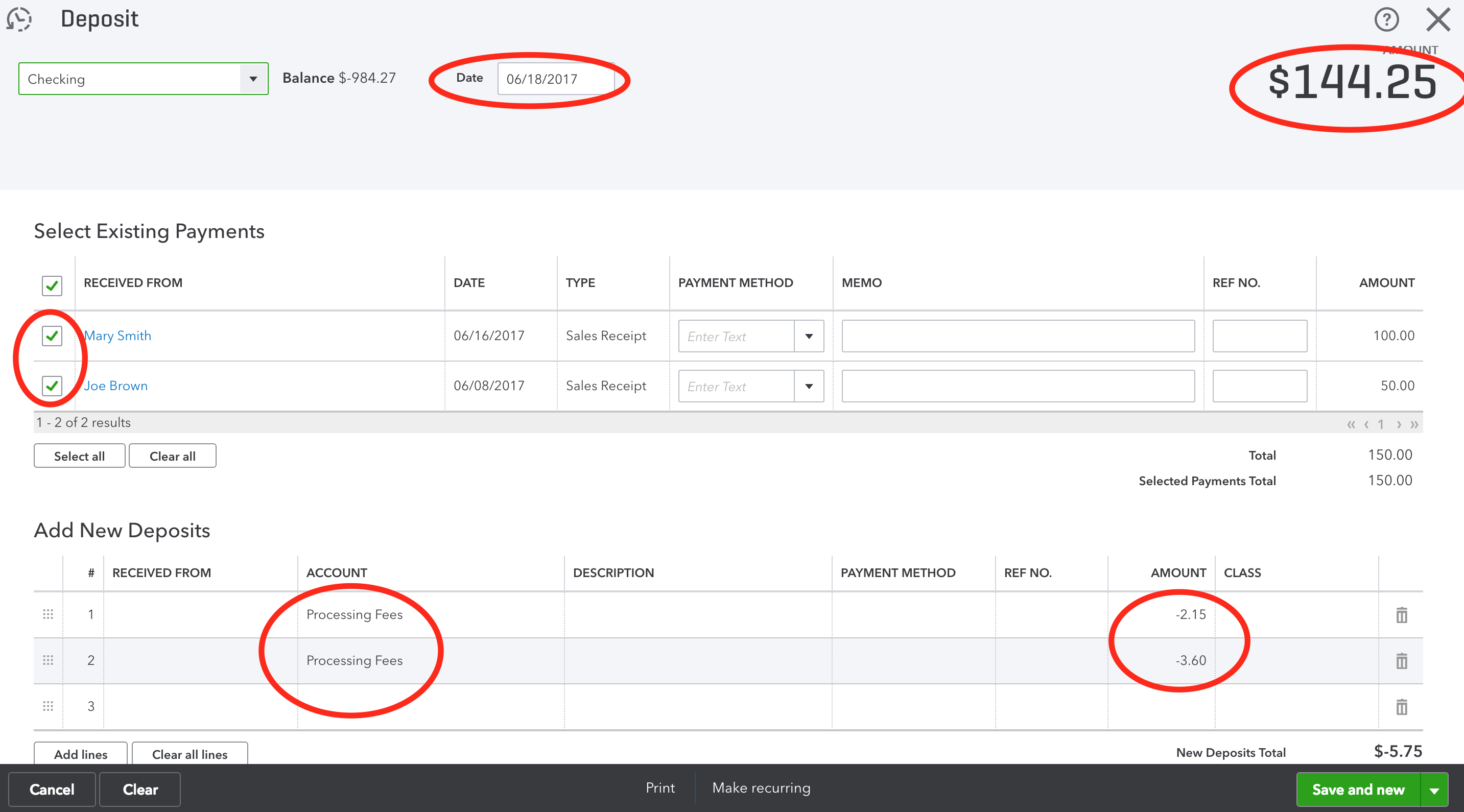

Now let's take those "undeposited funds to the bank and subtract the online processing fees...if applicable...

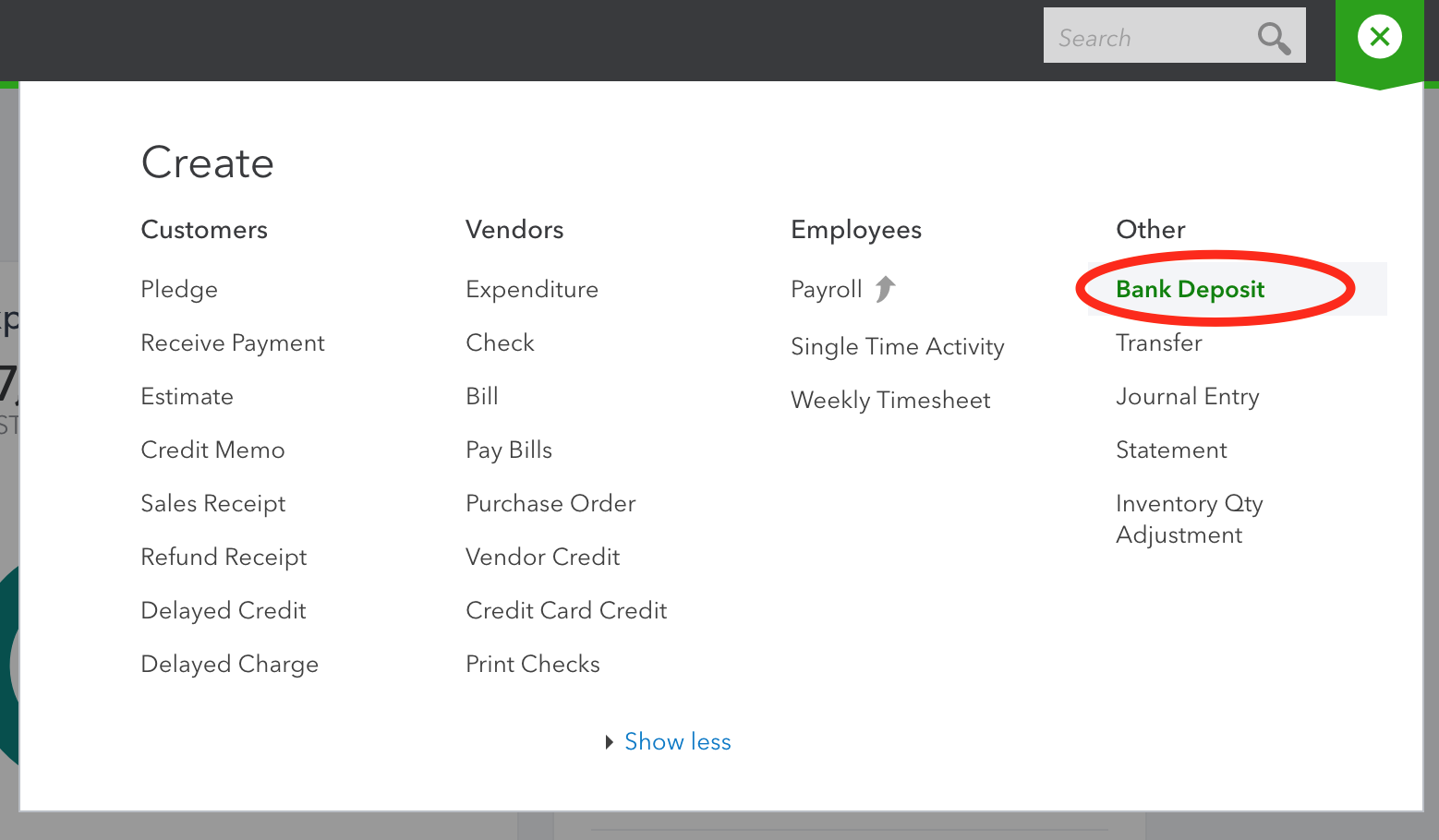

Click the Quick Create Button and then Bank Deposit. I like to have my online giving app open at this point or a report printed out that shows what donations are included in each deposit and how much the online fees were...

1. Select the bank account the funds were or will be deposited in.

2. Select the date of the deposit.

3. Select the donations that were included in that deposit.

4. Under "Add New Deposits" select the expense account you use to track your online processing fees.

5. Put the amount of the fees in as a NEGATIVE number!

6. Make sure the amount in the top right corner equals your actual deposit.

7. Click Save and New if you have more deposits to enter or Save and Close if you don't have any more deposits to add.

One last tip...if you have a large number of donations (online and onsite) to enter, use an app such as SaasAnt to import multiple transactions into sales receipts.

P.S. I also like to put the gross amounts and fees in as negative numbers when I am just assigning the online deposits in QBO (if the deposit is the "net" donations).

Want to set up QuickBooks Online for your church or nonprofit, but do not know where to even begin? Let Lisa London, CPA and author of QuickBooks for Churches and Nonprofits, take you step by step through setting it up and using QBO for your church or nonprofit organization in her online courses!

I highly recommend "The Accountant Beside You" QB ONLINE COURSES

*Use the discount code FCA for a 10% savings!

Handling Unusual Donations in QBO

I am going to include some tips on handling specific donations in QBO in the next few months.

The first one is how to handle Pass Through donations (donations received for other organizations).

There are a couple of ways to handle these types of donations. Which method you choose depends on your accounting requirements...or how you prefer to track the donations.

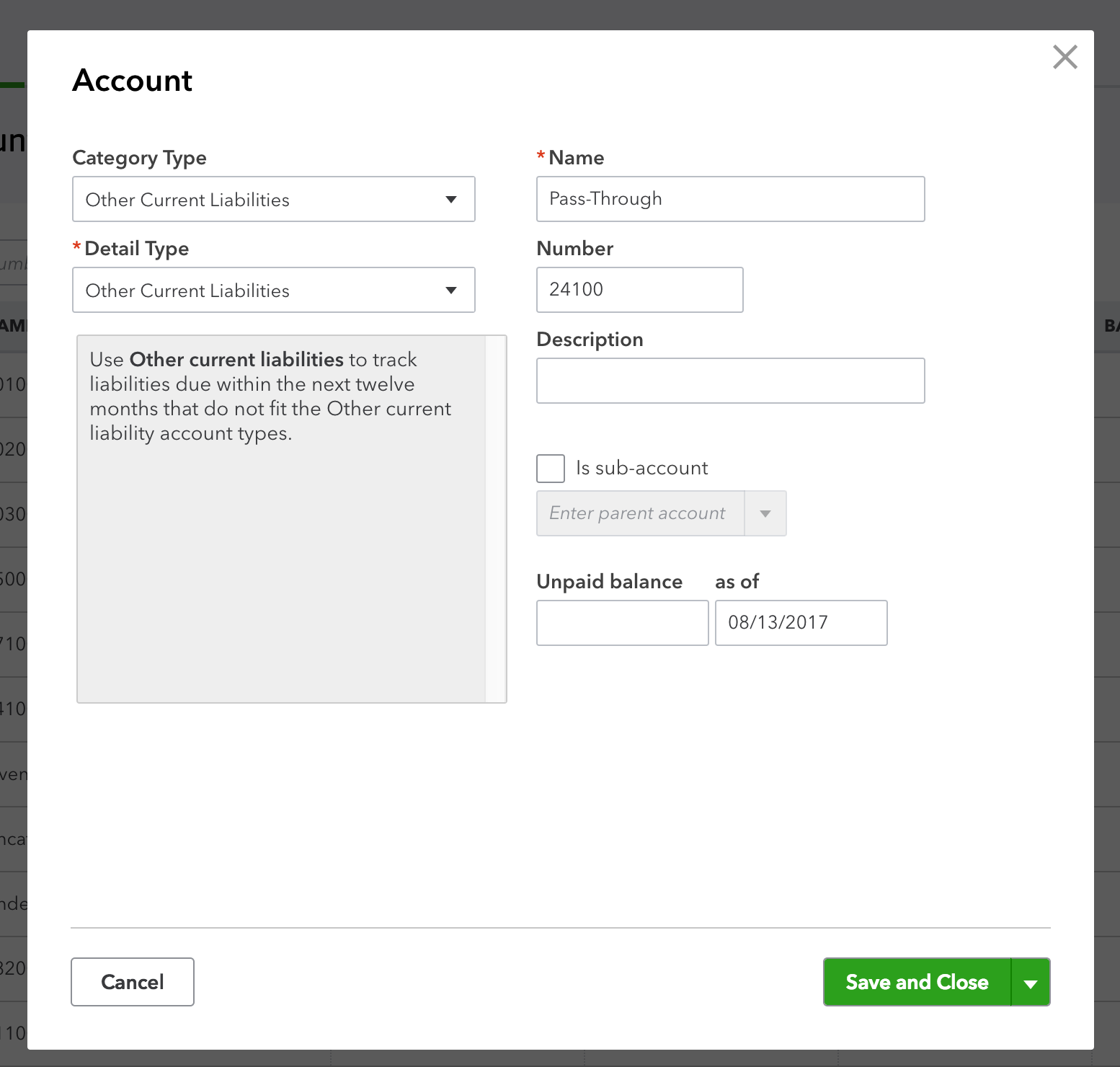

First method: Track pass through donations using accrued liability accounts.

Go to Accounting: Chart of Accounts.

Click on the green "New" button in the top right corner.

Category Type: Other Current Liabilities

Detail Type: Other Current Liabilities

Account Name: Pass-Through or whatever you what to title it

Add a appropriate number and description if desired.

Do not put a balance in! You can add in any beginning balances in through a journal entry.

You can add more accounts as sub accounts to track specific pass throughs. Just repeat that above steps and click the little box to indicate it is a subaccount of your original account.

If the pass through donation is eligible for a donation receipt ...then you will need to set up a Product/Service, so you can track the donation for a contribution receipt. See more below.

If no donation receipt is required, you can just create a bank deposit and assign your new liability account. When you pay the organization that the donation was collected for, you will assign the same liability account when you create the check or expenditure. That will zero out the liability account.

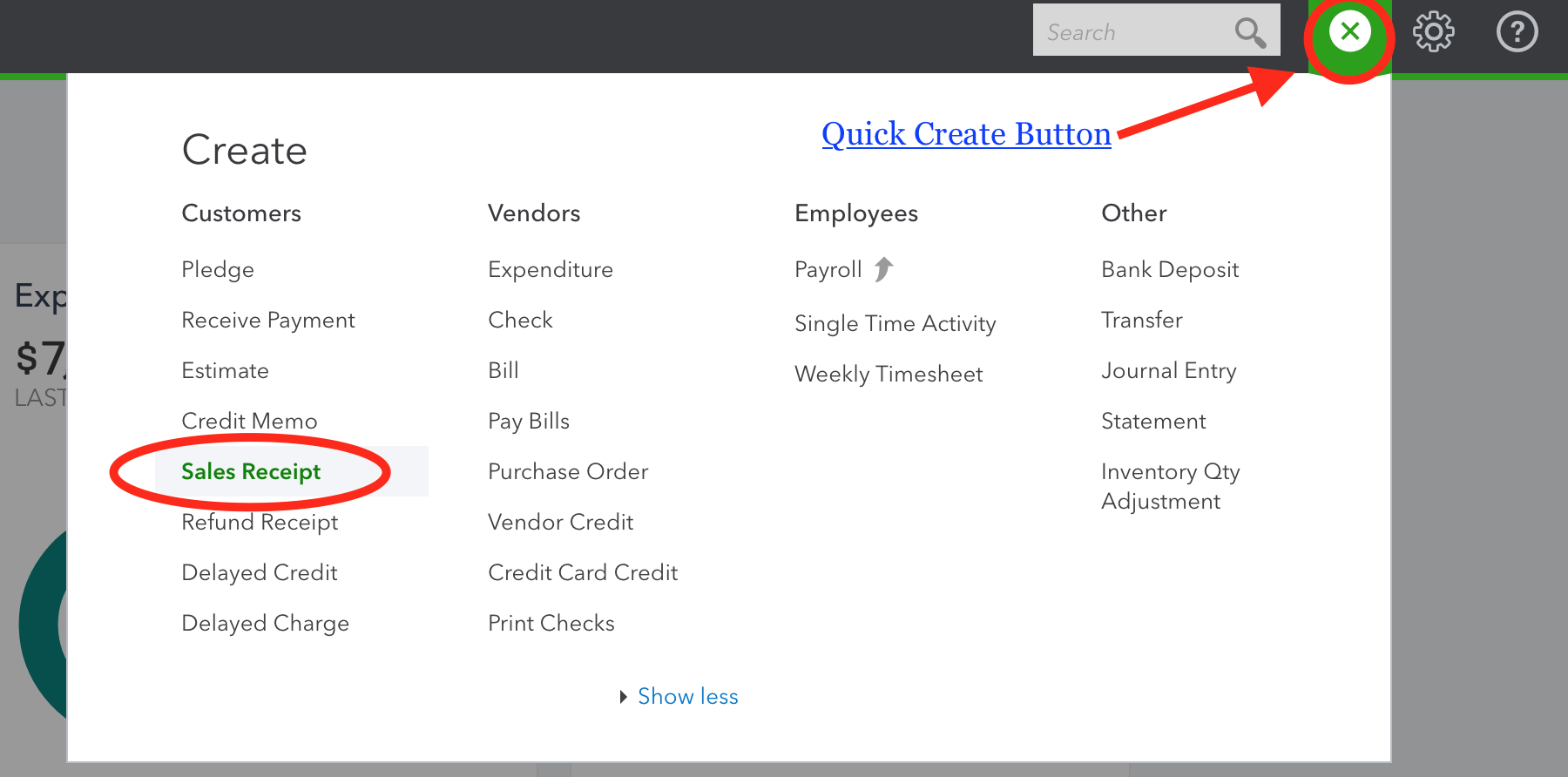

Second method: Using income accounts

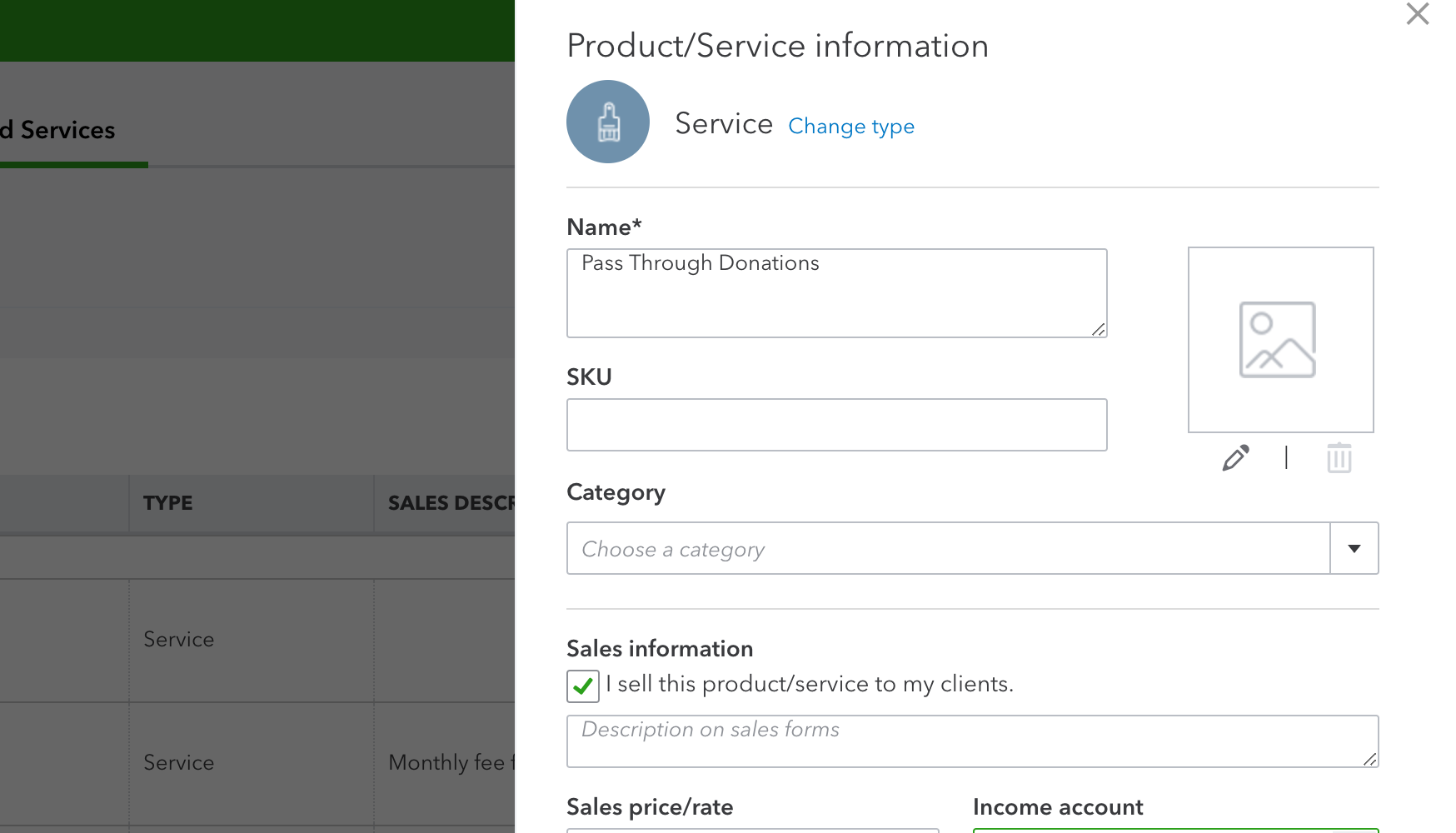

If you need to track the pass through donation for a contribution receipt OR if you just want to track those donations for management purposes, you can set up the pass thru donations as product/service items.

Go to the gear wheel at the top right (see image above). Then under the Lists column, go to "Product and Services".

Click on the green "New" button in the top right corner.

Choose the type: Service

Name it Pass Through Donations (or something similar) then choose which Income account you want to link to (Outreach or Pass Through Funding, or something similar?). Note: if you are using the accrued liability method, you can use that account.

"If you are receiving the donations through a fundraiser or cash not from a particular donor, set up a Customer named for the other organization (i.e. Food Bank). If the money is received from a donor, use their name instead.

Enter the donations as you normally would, but set the product/service item to the Pass Through Donation. If you are collecting for several different organizations, set up sub-product/service items to track by organizations. After all of the donations for are entered, run a Sales by product/service report for the time period of the donations to see the total dollars owed to the receiving organization.

You will now set up a product/service item with Service as the type called Pass Through Payments linked to an Expense Account-Payments of Donations to Others or Pass Through Donation. Set up any sub-items for any multiple organization to match the ones you set up above.

Next, go to the Vendor Center and set up the receiving organization as a Vendor.It cannot be the same as the Customer name, so simply add a "v" after the organization's name. Enter a bill for the amount of the donations (from the Sales by Item report) and charge it to the Pass Through Payments item or related sub-item. The check can then be printed as usual". (excerpt from the Accountant Beside You)

Check with your accountant to see which method you should use to record the pass through donations.

Comments...

Enter your title of your tip, idea, comment, or question in the text box below.

Keep the title as short as possible, but interesting enough to make people want to click on your title.

Then click on the link below it that says: Click here to see the rest of the form and complete your submission.

Write your post. Elaborate and give all the details necessary to properly convey your meaning or question,

Please be aware that with my bookkeeping company, building and maintaining websites, and my volunteer work at my church, I cannot possibly answer and comment on every submission.

However, your opinions, questions, and comments are very valuable to me...so I will try to answer questions when I can, but I am relying on the goodness of others to help here:)

Important! Comments used to go live without my approval. I would have liked to keep it this way, but there are some that take advantage of that. As a result of their blatant disregard of my request to stop posting their spam on this site... I now must approve comments first. I apologize for this inconvenience and will post your comments asap.

QuickBooks

Do you have a question or comment regarding using QuickBooks? Share it!

Archive of QuickBooks Questions and Comments

The following comments, tips, and Q/A were provided by FreeChurchAccounting's generous readers:

Accounting for Online Donations Issue

I went through the process of of the sales receipt and bank deposit to account for on-line processing fees.

But when I run a Statement of Activity …

How to transfer funds from one one class to another class in QBO

I use QBO for our church accounting. I need to transfer funds from our general fund to our designated building fund. I use classes in QBO. Both funds …

Uncashed Check Donated Back to the Church

We have recently been going through our bank accounts and dealing with a couple dozen checks that we have written out over the years that have never been …

How to process entries in Quickbooks for cash kept in the safe

Our church keeps some cash in the safe for approximately 2 ministries.

We do not deposit these funds in any of our bank accounts. We're keeping track …

QBO for Churches and Non-Profit Organizations - book not consistent with current QBO Sample

We are just now starting our chapel and purchased two of the books recommendations. In reading the QBO for Churches and Non-Profit Organizations, it refers …

Moving monies between funds

Thank you for all of your help using QB within a church. We have been using QB for a couple of years.

My question: we recently moved monies out …

Reimbursement of Church Expenses

We received donations from church members for a reimbursement of a mission leader appreciation dinner. I do not know how this should be added to QBO!

Membership Plus Switch to QB

We have been using membership plus and now must switch. Is QB for churches compatible where we can import our files from membership plus?

Keep Pledge information confidential

Using Quick Books, how do churches keep the member pledges confidential? Our Financial Secretary is the only person that should have access to who pledges, …

Software for churches with operating budgets between $1 million and $2 million

Thank you in advance for your assistance. I am researching new financial and membership software for my church.

I thought QB might be a good fit …

How do i enter church member contribution on quick books?

Do i enter it under Customer or payments received?

year-end record of contributions

How can I make and print a year-end record of contributions for all donors?

Switching from Church Windows to QuickBooks

Has anyone out there used Church Windows accounting software for their accounting at their church?

We have had a lot of issues with CHURCH WINDOWS. …

Windows Vista?

I am just starting as the church treasurer. Is Quick Books for Churches and non profits software compatible with Windows Vista? Thank you.

need to update

is there a free update for quickbooks 2011? I have Windows 10 and it suddenly stopped working

Track Group activites and payments quarterly

The church has five ministry groups that meets quarterly and need to turn in reports.

each ministry has 5 to twelve tribes that need to be submitted …

Compatibility

Which other QuickBooks products will open and read a data file created in QuickBooks Pro 2016?

QuickBooks Online

I use QuickBooks Online. Is there material available specifically for using QB Online for a small church with Grant contracts?

Vickey's Reply …

Annul receipts for Donner for QB Not for profit 2015

I have QB 2015 for not for profit. I want to send annual contribution receipt to all donors. I get summary for all donors BUT can not generate a receipts …

Quicken for Membership Records?

I was wondering... could I possibly use my existing Quicken program for my Membership? If so, can anyone advise how to go about doing so? Thanks for …

Quicken Business vs. Quickbooks Pro for a church preschool

I've been our church's preschool bookkeeper for a year now. I'm mostly self-taught when it comes to bookkeeping. When I started they had been using Quicken …

Quickbooks for Church giving

Right now we put weekly giving into an Excel spread sheet, and the book keeper then puts it all into RollCall, (we have 3 church locations). I wanted to …

Way too expensive!

I have used Quick Books for years for my church accounting. In the beginning it was wonderful. Not expensive and supported free for a year.

Now …

Our church began on-line Tithing this last September..HELP!

Our church began taking on-line payments from our church website though Paytrace which deposits credit card payments into a separate checking account that …

Church New to QuickBooks

We are currently using Quicken for a small church and I enter all of my entries by hand as the church is a little averse to the electronic downloading. …

converting quickbook pro to the non-profit version?

What is the conversion (upgrade) process from QuickBook Pro to the Non-profit version?

Now available as a donation!

I found out yesterday that Techsoup.org now offers the non profit version as a donation! There is an administrative fee, but it is SO much cheaper for …

how do you handle pre-paid pledges?

Each spring we have a pledge drive, asking members to commit to a specific amount they plan to give in the next fiscal year (July - June). Some like to …

Unique Identifier

Does Quickbooks have a unique identifier for each customer? Like an email address or a donor id?

We are looking to allow more giving options on our …

web hosting with quickbooks

We currently are using Quickbooks Pro 2013 and go through a web hosting company to access QB. Is the web hosting necessary? There is of course a cost, …

how to use quick books in a school

How do i post school fees in quick books and reconcile the school fees in quick books if i am using quick books in a school?

Quickbooks Upgrade

Hi I have been using Quickbooks Pro for a while - the 2008 version (I know, right!) and am about to upgrade to the 2014 version.

I was going to get …

first time giver report

How do you create a list of first time givers?

Class Tracking List Samples

I would love to see some sample list of classes in QuickBooks. I want to see how everyone is setting up their hierarchy. I am new to using this feature …

Recording fundraising transactions in Quick Books

As a fundraiser for our school, the Church purchases Gift Cards in bulk thru GL Scrip Program. Our cost is less than the face value for which the cards …

How do I set up members and enter their contributions into Quickbooks Pro

How do I set up members and enter their weekly contributions into Quickbooks Pro 2014 under customer/transaction section?

Quickbooks Pro vs. Premier for Non-Profits

I have QB Pro 2012 and I'm thinking about upgrading to Premier because it's industry specific (NonProfit). My main question is if I did this, would I …

Could you please elaborate on the benefits of class tracking?

I understand the desire to keep track of funds, but am not sure of the benefits of using class tracking to do it. What do you think of setting up separate …

Payroll

Does this edition have payroll capabilities?

recording non-cash contibutions in QB Premier Non-Profit 2013

How do I enter a non-cash contribution ie. a person buys cups for $12.50 and wants to donate them, but the church needs to track the expense.

Should Quickbooks Funds/Classes have beginning Balances?

I have just been appointed Treasurer/Bookkeeper of a church which converted to Quickbooks Pro as of July 1, 2011.

They set up the "classes" as the …

Printing Reports for Church Giving

I am financial secretary of a small church. We have Quickbooks Nonprofit.

This is my first time to print individual donor reports for income tax …

Donor Receipts in Quickbooks Non-profit

I am having a difficult time finding an appropriate report for a donor receipt. Especially one that gives the year-to-date amount as part of the receipt …

QuickBooks Online Plus

Is anyone using this version of QuickBooks? We are a quickly growing church (1200+ weekend attendance)with 2 users and no inhouse server, so we are considering …

Tracking Pledges

We use QuickBooks Online for the Operating Account in my church of about 100 members.

I am the treasurer, and have a question about tracking pledges. …

quickbooks 2011 non profit

Has anyone used this version? I am taking over for a very small church accounting. I want something fast and simple as I work about 50 hours a week at …

Item List in Quickbooks

What should the item list in Quickbooks be used for in a Church's accounting system? And how would it differ from the class list? Or would it?

Know …

How do I transfer money from the church savings account into the general fund?

I'm trying to transfer funds from savings into checking then to the general fund so that all accounts can show that the transaction took place.

I'm …

Setting up donors in Quickbooks

I've noticed where I can add contributors to our Church as customers in Quickbooks, but when I practice and add some receipts to see how it works, I am …

Will Quickbooks or Quickbooks Pro automatically keep running balances on general ledgers

You suggested that since I have a lot of expense accounts that I should purchase double entry such as Quckbooks.

I noticed on your spreadsheets GL …

Quickbooks and Fund Accounting

Question on fund accounting in QuickBooks:

Thanks so much for your site! I am the secretary for a small church and am responsible for helping our new …

QuickBooks

How much instruction and examples does this program provide for setting up the churches records in quick books? If I choose to purchase this and quick …

Fund "Balance Sheet accounts" within Quickbooks class accounting

In your Fund Accounting book, when using Quickbooks, the Class Tracking is recommended.

Having done that I see how to run P&L type reports but is there …

Is QuickBooks Overkill for a Small Church?

I have recently been asked to serve as church treasurer for a small church in a small south Texas town.

Average regular Sunday worship attendance …

Quickbooks for Church Use

Can Quickbooks be used to track individual giving by members?

Answer

You can keep track of individual contributions by entering each member …

Fund Accounting in Quickbooks

Question regarding class tracking in Quickbooks:

Which method do you recommend for a small church to use that has Quickbooks software? I'm trying to …

Quickbooks User.

Question regarding QuickBooks:

Hello, I'm the bookkeeper for a local church in Rogersville, MO. I've been reading your site and it's given me several …

Using Quickbooks to Track Various Funds

We use Quickbooks to manage the Church budget but within the budget we have line items for various ministries and each of those could have a fundraiser …

Quickbooks for Churches and NonProfits

I'm curious about using the Quickbooks setup with equity accounts. I have a number of funds - church, school, capital campaign, youth group - for starters. …

The comments above are for general information purposes only and do not constitute legal or other professional advice on any subject matter. See full disclaimer.