Top 6 Payroll Mistakes with Churches and Nonprofits!

In my bookkeeping practice, I encounter payroll mistakes within churches and nonprofit organizations of every size.

Unfortunately, even those that utilize a payroll service or software may still be out of compliance, as many payroll providers lack the expertise to correctly set up and manage payroll for these entities. Such mistakes can lead to significant financial repercussions.

Below are the six most common payroll mistakes I frequently observe in my work...

Coupon!

Here is a 10% discount code for all the ebooks, spreadsheets, and packages on this site:

FCA

Note: click on "PACKAGES" in the top navigation bar for a list of all of the ebook and spreadsheet packages on this site!

Payroll Mistakes #6: State Exemptions

Never assume that your church or organization is "exempt" from federal regulations and automatically exempt at the state level.

- For instance, while churches and nonprofits are exempt from FUTA (federal unemployment taxes), they might not enjoy the same exemption at the state level. It's advisable to consult your state's unemployment agency.

- Another example involves nontaxable income, such as a housing allowance. Although it may not be taxable federally, it could be subject to state taxation. Check with your state's revenue agency for clarity.

Take the time to research your state's employment taxes to understand what your organization is exempt from and what it may still be liable for.

See the bottom of this article on "Tax Exempt Status for Churches" for additional state exemption regulations.

The Church Accounting: How To Guide devotes a whole section of the book to payroll for churches. It covers payroll terminology and forms and then takes you through the steps necessary to set up a payroll, calculate and file the necessary taxes and forms, and even details how to handle the minister's payroll. It also includes sections on filling out IRS forms: 1099-Misc, 1099-NEC, and 1096.

If you have QuickBooks or are considering using it in the future, go ahead and purchase the QuickBooks for Churches and the How To Guide combo for a complete package on setting up and administering a payroll using QuickBooks.

Payroll Mistakes #5: Paying Individual Health Insurance Premiums

I have observed several well-meaning churches covering their employees' individual health insurance premiums. This can be a nontaxable reimbursement if established correctly. Payroll errors often occur when these reimbursements are not aligned with ACA (Affordable Care Act) guidelines. If not set up properly, these healthcare reimbursements can violate ACA requirements and lead to penalties.

Additionally, there are strict guidelines surrounding these types of healthcare plans, so it's essential to be aware of them and ensure compliance.

Another common payroll mistake is categorizing an employee's health insurance premium as "pre-tax."

"Generally speaking, an employee contribution toward health coverage is deducted from wages on an after-tax basis unless the employer establishes a special arrangement under Section 125 of the federal tax code."

...excerpt from Health Coverage Guide's article: Tax Implications

As I am not an expert in HRAs or health insurance, I strongly recommend consulting a benefits or HR professional. It is crucial to ensure your church's payroll is accurately set up concerning the tax implications of health insurance benefits.

NOTE: Healthcare Costs Sharing Plans such as Samaritan Ministries are NOT considered insurance and the monthly cost to participate in those plans do NOT qualify as medical expenses and cannot be reimbursed through a QSEHRA. If you are reimbursing your employee for the cost of participating in one of those plans OR paying the fee directly, you must include those payments in your employee’s taxable income.

Donation Guidelines Package

A set of 4 ebook packages that covers many of the following topics...

- How to handle and receipt stock donations

- How to handle free rent and labor donations

- How to handle non-cash contributions

- What to do if you receive a DAF (donor advised fund) contribution or grant

- How to handle Quid Pro Quo donations and other fundraising income such as drawings and raffles

- Donation policies and procedures

- Much more - Click here for details

Payroll Mistakes #4: No Payroll Forms on File

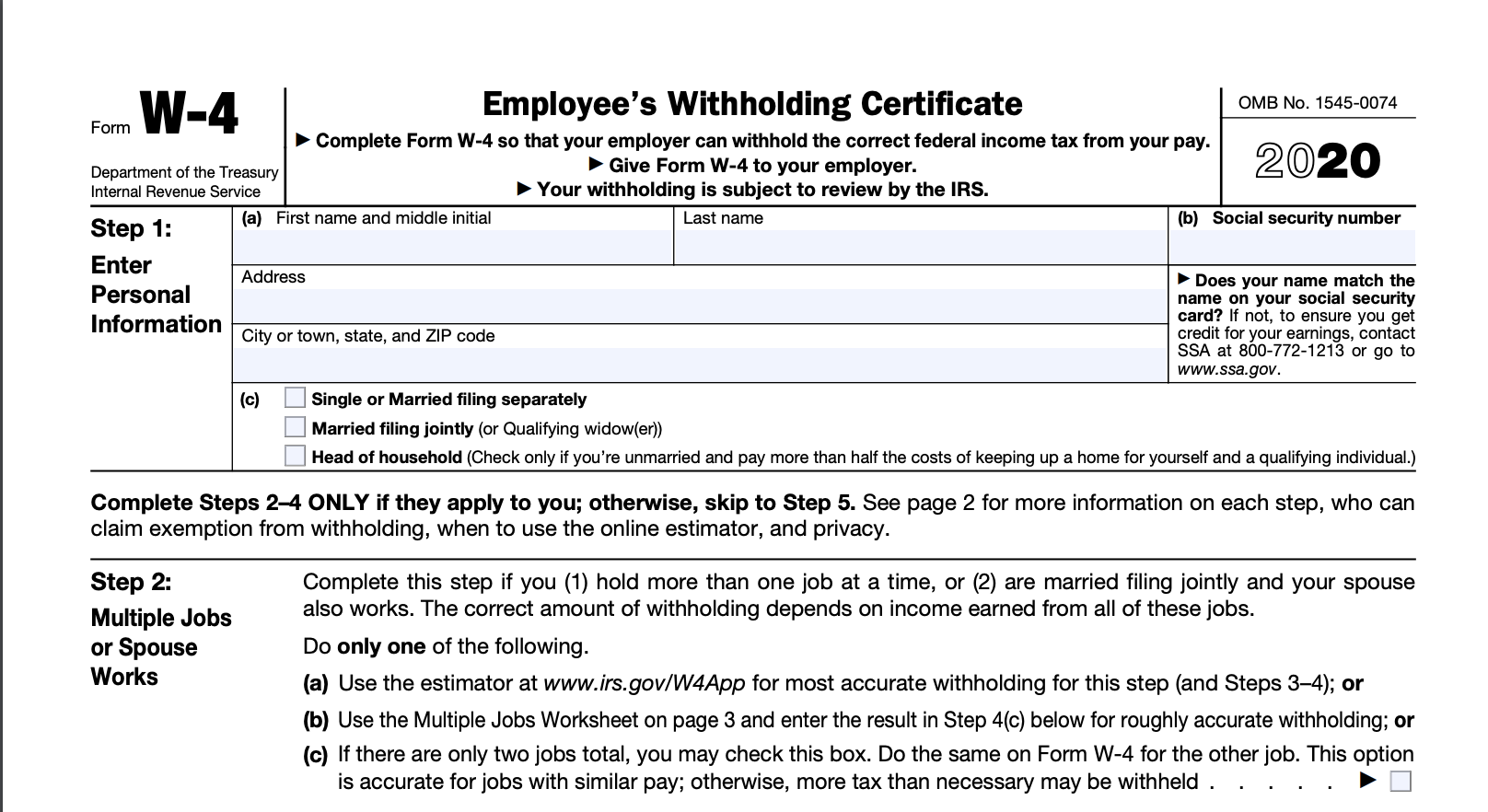

Before issuing the first paycheck to your employee, ensure you have a W-4 and an I-9 form on file.

- The W-4 form is essential for gathering the correct information to set up that non-minister employee in your payroll system. It also indicates how much should be withheld for payroll taxes.

- If an employee wishes to change their withholding, always obtain a new, completed, and signed W-4 before making any adjustments. This will prevent any potential issues next year if they feel too much or too little was withheld and they do not recall requesting the change.

- Additionally, the government mandates that you verify your employee's eligibility to work in the United States. This can be done by having them complete and sign an I-9 form and by collecting copies of the necessary supporting documents.

- If you offer direct deposit for their paycheck, ensure you have a signed and completed direct deposit authorization form on file.

For further details on the documents required for payroll, please refer to this Step-by-Step Payroll Guide.

Tip: do not rely on your payroll system or company to keep all your payroll records. At the very least, keep a copy of each payroll’s register securely on file.

I had a consulting client call me in tears because her payroll system glitched (a well known payroll processor!) and lost an entire quarter of their payroll that she had to rebuild with no payroll records. It was time consuming and emphasized the importance of "back ups".

Payroll Mistakes #3: Not Including Taxable Income

The following compensation types must be analyzed to determine if they should be reported in Box 1 of an employee's W-2:

- Bonuses and Gifts: This is one of the payroll mistakes I see that occurs frequently. If you give your employees a Christmas or year-end bonus or appreciation gift (whether cash or a gift card), the cash should be processed through payroll with all applicable withholding taxes applied. Also, cash and/or gift cards must be reported in Box 1 of their W-2.

- SECA Allowance: You can assist your minister with a portion of their self-employment tax by providing an "allowance" for the 50% that churches cannot "match" like they do for all FICA (non-minister) employees. However, this is taxable income and must be reported in Box 1 of their W-2.

- Car Allowance: You may offer your minister a fixed monthly car allowance; however, this is taxable income and must be reported in Box 1 of their W-2. A more effective approach is to establish an accountable reimbursement plan that allows for tax-free reimbursement based on actual miles driven for church-related activities.

- Medical Sharing Costs: As mentioned earlier, you can reimburse your employee for their participation in a medical sharing plan like Samaritan Ministries; however, this is considered taxable income and must be included in Box 1 of their W-2.

- Cell Phone Reimbursement: The church can provide a tax-free cell phone for a minister or employee who needs one for church duties. However, if the cell phone is provided or reimbursed for an employee who does not require one for their responsibilities, it becomes taxable.

**Tip:** If you pay for an employee's cell phone and they do not have a personal phone, some of the monthly charge may be considered taxable income for the portion used for personal purposes.

**Unsubstantiated Business Expenses:** If you have employees who are slow to submit their receipts, remind them that missing receipts for items purchased for the church and paid for with church funds may lead to those amounts being included in their taxable income according to IRS regulations.

The Policies and Procedures Package includes an ebook on Receipts and Reimbursements that explores the management of receipts and supporting documents.

Additionally, it provides insights on establishing and managing an efficient accountable reimbursement policy.

Includes a sample of a resolution you can use to present to the board to set up and approve an accountable reimbursement plan.

.

This ebook is included in the Policies and Procedures Package. However, you can purchase it by itself for only $7.95 by clicking the ADD TO CART button below!

The Receipts and Reimbursements ebook is also part of a larger "Policies and Procedures" Package" that is packed full of valuable information and for a limited time you can purchase all 5 ebooks and 8 policy templates for only $32.80

Payroll Mistakes #2: Paying Ministers Through the FICA System

Those of you who have followed my newsletter and articles for many years are aware that I emphasize this topic frequently, as it ranks among the most significant payroll mistakes I notice within churches.

Ministers hold a unique status with the IRS. For income tax purposes, they are classified as employees of their church, but in the context of Social Security taxes, they are regarded as self-employed. IMPORTANT: They cannot opt to be compensated as a "regular" employee; this is not a choice but a legal requirement.

Ministers receive payment through the Self-Employment Contributions Act (SECA) System rather than the Federal Insurance Contributions Act (FICA) system. This means that FICA taxes cannot be withheld or matched for ministers!

For further details, please refer to this article about a minister's status with the IRS.

If you are currently compensating your minister via the FICA system, you risk jeopardizing their housing allowance and, more seriously, exposing them to potential charges of tax evasion.

The Compensating Ministers Package includes three ebooks on how to compensate and pay your ministers; what minister benefits could potentially hurt the minister and the church; how to set up a housing allowance and report it; and how to handle ministers' gifts/love offerings. Also includes an example of a W-2 for a minister.

Additionally there is a sample of a resolution you can use to to set up and approve a housing allowance for your ministers; an estimate worksheet for the minister to use to help the church determine the amount of the housing allowance; and an example of a notification letter the church can use to inform the minister on the amount of housing allowance payments paid during a calendar year.

All 3 ebooks are only $18.55 PLUS you can use the discount code: FCA for an additional 10% off!

Payroll Mistakes #1 Classifying Workers Incorrectly

The most common payroll mistake I encounter is the misclassification of workers.

According to the IRS, churches can categorize workers into four distinct groups:

- Volunteers

- Ministers

- Employees

- Independent contractors

It is crucial to classify each worker accurately, as errors in classification can be quite costly. Historically, the IRS relied on three primary factors to determine a worker's classification:

- Behavior control

- Financial control

- Relationship with the parties

Currently, the IRS employs a more comprehensive framework. Refer to the new regulations that the Department of Labor uses to assess whether your worker qualifies as an employee or an independent contractor (IC): Misclassification of Workers

While the IRS still considers those three factors, additional rules and regulations have made it increasingly challenging to classify a worker as an IC—unless they operate their own business performing the same tasks for you. I will outline the three factors mentioned above, but I recommend reading other articles on misclassification of workers for further insights.

1) In short, behavioral control assesses whether the organization can dictate when, where, and how the worker performs their tasks. If so, the worker is likely considered an employee.

2) For financial control, consider whether the worker uses supplies provided by the church or gets reimbursed for business expenses incurred out of pocket. If so, the IRS may classify them as employees. Furthermore, if their compensation depends on the church's revenue and they offer similar services to multiple churches or organizations, or if they receive a flat fee for their services rather than a regular wage, they might be classified as independent contractors. However, you still need to evaluate the other two factors before finalizing this classification.

3) The final factor is the relationship. If you provide benefits like vacation and sick leave, insurance, and retirement plans, the worker is typically considered an employee. Additionally, consider the duration of the work agreement; independent contractors are usually hired for specific time frames. If a worker continues to receive a 1099 from your church year after year, it could raise a red flag for the IRS.

NOTE: Ministers and especially pastors are usually considered employees of the church.