Donation Guidelines Package

Explore donation guidelines that assist in tracking, documenting, and acknowledging both monetary and non-monetary contributions!

Proper handling of donations is crucial for small churches and nonprofits. It ensures transparency, accountability, compliance with legal and tax requirements, and fosters good stewardship and organizational culture. Proper management also builds trust with donors, boosts donations, and enhances the organization's reputation

Coupon!

Here is a 10% discount code for all the ebooks, spreadsheets, and packages on this site:

FCA

Note: click on "PACKAGES" in the top navigation bar for a list of all of the ebook and spreadsheet packages on this site!

Donation Guidelines Package

Included in this package are all 4 ebooks listed below and the customizable Contribution Statements and Count Sheet found in the Spreadsheet Package

Bought separately, you would pay $38.70, but for a limited time, you can purchase all 4 eBooks, customizable Count Sheet, and Contribution Statements for only...

Book 1 in the Donation Guidelines Series:

Policy and Procedures for Donations

Discover the proper procedures for managing offering envelopes, processing donation checks, tallying contributions, and more. Additionally, explore some policies and protocols that can be implemented to protect donations effectively. Also includes how to handle predated, postdated, and errors on contribution checks and how to record contributions with a couple.

This 24 page ebook covers the following topics:

- Policies & Procedures for Donations

- Offering Envelopes

- Handling Donation Checks

- Depositing Donations

- Recording Contributions

Included in the Donation Package! However, you can purchase it by itself for only $7.95 by clicking the ADD TO CART button below!

Book 2 in the Donation Guidelines Series:

Cash & Unique Contributions

Explore the guidelines and criteria for issuing charitable contribution receipts.

Also, find out how to manage special donations like free or discounted rent or services, love offerings, and gifts to other organizations.

This guide includes a sample of an annual contribution statement.

This 19 page ebook covers the following topics:

- Receipt Guidelines

- Annual Contribution Statement Example

- Issuing Contribution Receipts

- Unique Donations: Donations To Another Charity

- Donated Labor/Services

- Discounts and Free Rent

Included in the Donation Package! However, you can purchase it by itself for only $7.95 by clicking the ADD TO CART button below!

Donation Guidelines Package

Included in this package are all 4 ebooks listed below and the customizable Contribution Statements and Count Sheet found in the Spreadsheet Package

Bought separately, you would pay $38.70, but for a limited time, you can purchase all 4 eBooks, customizable Count Sheet, and Contribution Statements for only...

Very well written. Lots of important information needed with today's changes in rules and laws.

Answered a lot of questions I had regarding donations.

Would highly recommend to others in church administrations.

-B Holland

Save 10% on all Accounting and Contribution Packages!

Type FCA in the DISCOUNT box found at the bottom of your shopping cart and click GO!

Book 3 in the Donation Guidelines Series:

Noncash Donations

Find out what a CWA is and why every noncash donation exceeding $250 requires one. Explore the procedures for handling donations of vehicles, boats, and planes. Learn about the requirements for noncash contributions over $500 and over $5000.

This 25 page ebook covers the following topics:

- NonCash Contribution Guidelines

- Noncash Donation CWA Example

- Noncash Donations Valued Over $500

- Noncash Donations Valued Over $5,000

- Church Reporting for Noncash Donation Over $5,000

- Autos, Boats, and Airplanes

Included in the Donation Package! However, you can purchase it by itself for only $7.95 by clicking the ADD TO CART button below!

Book 4 in the Donation Guidelines Series:

Stock & More Unique Donations

Discover the guidelines for accurately receipting a stock donation. Additionally, understand the process of receipting a donation involving goods or services exchange. Delve into how to handle raffles and games of chance donations. Lastly, gain insight on managing donor-advised fund (DAF) grants.

This 25 page ebook covers the following topics:

- Stock Donation Guidelines

- Stock Donation Receipt Example

- Quid Pro Quo Donations

- Quid Pro Quo Donation Receipt Example

- Donor-Advised Fund (DAF) Contributions

- DAF Thank You Letter Example

Included in the Donation Package! However, you can purchase it by itself for only $7.95 by clicking the ADD TO CART button below!

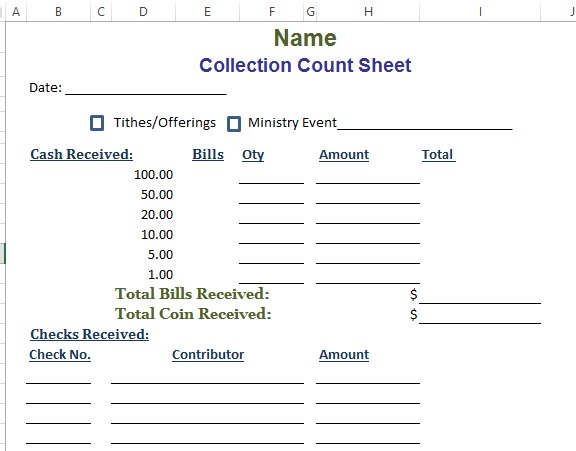

Bonus in the Donation Guidelines series:

Collection Count Sheet

A customizable worksheet used for a collection/offering count. It has fields to enter checks and cash received. It also has fields for up to 3 signatures.

This form is ready to use. Simply click on the "Name" cell and type in your organization's name.

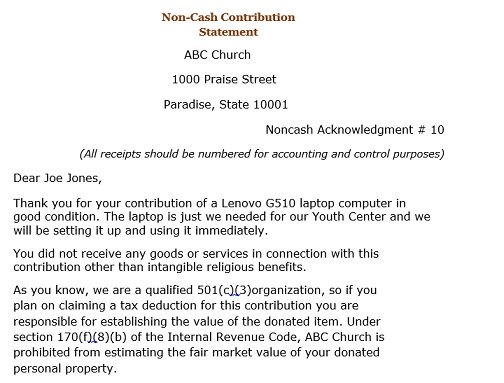

Bonus in the Donation Guidelines series:

Contribution Statements

This Word document has 3 examples of giving receipts for cash, noncash, and fundraiser donations.

The Customizable Contribution Statements includes: Annual Cash Contribution Statement, Noncash Contribution Receipt, and Quid Pro Quo Contribution Receipt

More Testimonies:

"Great help - doing a bible college business plan and this site and books were a great help"

Charmaine from Boksburg

"This E-book helped reassure me that I am on the right track in regards to the spreadsheets that I had already set up for our church prior to finding your site. Also, I am sure that as our church grows the book will be even more helpful in guiding me in various areas.

Thank you....and God Bless!"

-Deb from OK

"Great. Useful! I don't work for a church, but I do work for a nonprofit and this book easily translates for use in other fund accounting atmospheres."

-Rob from New Market, TN

Your Accounting Package purchase is 100% safe and secure - and 100% risk-free with SendOwl and PayPal.

Your order will be processed in seconds - and then you can download the ebooks and spreadsheets immediately from the web.

You can start reading them today!

Note: If you do not receive an immediate download link with your purchase or if you are having problems with the checkout process, please review this FAQ page or contact me.

These ebooks are in PDF format so you will be able to read it on a Windows PC, an Apple Mac, an iPad, a tablet, or some smart phones by using reader software such as Adobe Acrobat which you can download here or your app store for free.

The spreadsheets are in an Excel file, so you must have MS Excel, Numbers, or other similar spreadsheet applications installed on your pc or tablet in order to open the spreadsheets. You can also download free spreadsheet application software from openoffice.org

My Personal Guarantee:

All eBook Packages comes with a No-Questions-Asked-30 Day Guarantee: If you're not satisfied with this eBook, just contact me. within 30 days of your date of purchase - and I'll issue your 100% refund ASAP.