Quarterly Checking Account Balance Brought Forward

by Jim

(Adams Co Wisconsin USA)

How should the checking account balance brought forward from the end of the previous quarter be recorded in the following quarter report?

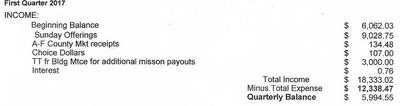

At our quarterly business meeting today, I noticed that the checking account balance brought forward from the end of the previous quarter was listed under Income, and it was also counted with donations, offerings, etc., toward the amount of Total Income of the reported quarter.

It's been done this way, I've been seeing the reports for about 5 years, and only today noticed this oddity.

Is this the proper way to account these funds?

Comments for Quarterly Checking Account Balance Brought Forward

|

||

|

||