Accounting for In-Kind Donations

How to Acknowledge and Record In Kind Gifts

At times, churches and nonprofits receive in-kind donations, which include items, use of property, and professional services. Managing the accounting for such donations can be challenging. Explore ways to properly recognize and record these contributed goods and services.

Coupon!

Here is a 10% discount code for all the ebooks, spreadsheets, and packages on this site:

FCA

Note: click on "PACKAGES" in the top navigation bar for a list of all of the ebook and spreadsheet packages on this site!

In-kind donations are basically gifts of tangible and intangible personal property and donations of services.

There are typically three categories of in-kind donations. They are

- contributions of tangible and intangible goods

- use of property

- donations of services

Some examples of tangible gifts in-kind (physical goods that can be touched or held) include:

- furniture donation

- equipment donation

- food donation

- clothing donation

- inventory, and supplies

Some examples of intangible gifts in-kind (goods have value but do not have a physical presence) include:

- trademarks

- copyrights

- patents

- royalties

- advertising

Examples of use of property include:

- leased space

- discounted rent

Gifts in-kind can include professional services rendered by:

- accountants and bookkeepers

- lawyers

- plumbers

- electricians

- nurses and physicians

- Computer programmer, designers, technical support, etc.

- Contractors

Now that we have established what a in-kind donation is, let's move on to "how and when" to record those donations!

Donation Guidelines Package

A set of 4 ebook packages that covers many of the following topics...

- How to handle and receipt stock donations

- How to handle free rent and labor donations

- How to handle non-cash contributions

- What to do if you receive a DAF (donor advised fund) contribution or grant

- How to handle Quid Pro Quo donations and other fundraising income such as drawings and raffles

- Donation policies and procedures

- Much more - Click here for details

Donation Valuation:

Starting with the importance of having a written policy, every nonprofit organization and church should establish guidelines for accepting or declining in-kind donations. A general rule is to reject items that cannot be utilized or sold.

When deciding whether to document these donations in your financial records, a good guideline is to record in-kind contributions that hold value and would have been bought if not donated by the organization. For instance, if a donor provides computers and printers for the church's office use, their value can be recorded as fixed assets.

Valuation methods for in-kind gifts vary depending on the donation type. Bulk donations from retailers or manufacturers, like canned goods or backpacks, can be valued at wholesale prices. Property donations, such as rent discounts, should be valued at fair market rates.

For donated services, recording is necessary when the service demands specialized skills or would have been purchased otherwise. However, despite being recorded in accounting, the IRS doesn't permit tax deductions for donated services, so contribution receipts are not issued (more on that below).

The Policies and Procedures Package includes an ebook on Receipts and Reimbursements that explores the management of receipts and supporting documents.

Additionally, it provides insights on establishing and managing an efficient accountable reimbursement policy.

Includes a sample of a resolution you can use to present to the board to set up and approve an accountable reimbursement plan.

.

This ebook is included in the Policies and Procedures Package. However, you can purchase it by itself for only $7.95 by clicking the ADD TO CART button below!

The Receipts and Reimbursements ebook is also part of a larger "Policies and Procedures" Package" that is packed full of valuable information and for a limited time you can purchase all 5 ebooks and 8 policy templates for only $32.80

How to Record In-Kind Donations in your Accounting Books:

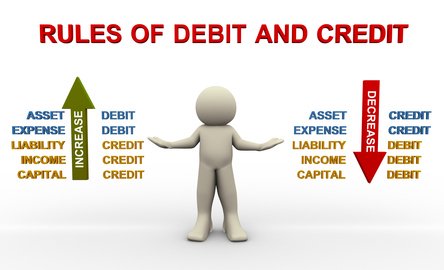

How you record the in-kind contribution in your accounting records will depend on your accounting software. In most accounting systems, you will record the gift in-kind as a journal entry. However, you will need to first set up some new accounts in your chart of accounts...such as:

- In-Kind Contributions (income)

- Professional Service In-Kind (expense)

- Supplies (expense)

- Equipment In-Kind (expense...if donation NOT considered a capitalized asset)

- Assets In-Kind (fixed asset)

If you use QuickBooks:

Lisa London's book "Using QuickBooks Online" explains how to set up and record in-kind donations with journal entries and gives step by step examples. Let me stop here and encourage EVERY church or nonprofit that use or plan on using QuickBooks Online (QBO) to purchase Lisa's book and keep it beside your computer! It has hundreds of screen shots and step by step instructions on pretty well everything you need to do to make QuickBooks work efficiently for you.

If you use Aplos:

See Alex's great examples of journal entries for recording donated items.

Some in-kind contribution journal entry examples...

An accountant donates 5 hours a month to do some accounting work that your organization would have had to pay another accountant to do. She regularly charges $100 per hour to do a similar service. To record this gift in-kind you would:

- Debit Professional Service In-Kind $500

- Credit In-Kind Contributions $500

Another example:

A business donates a portable building valued at $12,000. Assuming that your organization has a policy to capitalize assets of this value, you would record this gift in-kind like this:

- Debit the fixed asset account (Portable Building In-Kind) $12,000

- Credit the In-Kind Contributions $12,000

Another business donates an air conditioner valued at $800. Assuming that your organization has a policy to expense assets of this value, you would:

- Debit the Equipment In-Kind (expense account) $800

- Credit the In-Kind Contributions $800

The Compensating Ministers Package includes three ebooks on how to compensate and pay your ministers; what minister benefits could potentially hurt the minister and the church; how to set up a housing allowance and report it; and how to handle ministers' gifts/love offerings. Also includes an example of a W-2 for a minister.

Additionally there is a sample of a resolution you can use to to set up and approve a housing allowance for your ministers; an estimate worksheet for the minister to use to help the church determine the amount of the housing allowance; and an example of a notification letter the church can use to inform the minister on the amount of housing allowance payments paid during a calendar year.

All 3 ebooks are only $18.55 PLUS you can use the discount code: FCA for an additional 10% off!

How to Acknowledge In-Kind Donations:

In addition to recording the gifts in-kind in your accounting systems, it is appropriate to acknowledge the non cash contribution by generating a donor receipt. Unlike the recording of those donations, you should NOT (in most cases) include a value on a non cash contribution receipt. See an example of a non cash contribution receipt.

The exceptions to this rule include donations of vehicles, boats, and planes. The rules regarding those donations and donations valued at $500 plus can be found on the IRS's site and my ebook package "Donation Guidelines" is a great resource as well as it details how to handle and acknowledge those donations along with other uncommon contributions.

Note: the IRS does NOT allow charities to issue charitable contribution receipts for donated services! Donated services such as the accountant work discussed above is not a tax deductible contribution for the donor (Rev. Rul. 162, 1953-2 C.B. 127). See more about donated labor and free rent donations in Book 2 of the Donation Guidelines Package.

Also...you cannot issue a contribution receipt for discounted or free rent as the IRS has determined that rent free use of real or personal property does not represent a “payment” under IRC 170(a)(1)(Rev. Rul. 70-477, 1970-2 C.B. 62). BUT if the donor donated all or part of real property and transferred the title to the nonprofit, you could issue a noncash contribution receipt =)