Payroll has been deducting SS and Medicare from Pastor's pay check, is that correct?

by Karen

(Houston Texas )

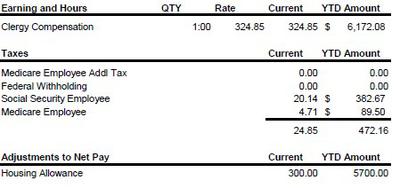

I'm a volunteer at a small church helping with finances and in reviewing the books I noticed the Pastor is having SS and Medicare taxes withheld from the paycheck.

The person doing the payroll confirmed and the church is also filing them and paying them on the 941. However the housing allowance is not being included in the 941 payments.

They have been doing the same since 2021. My understanding is that the Church should not be paying for the SS and Medicare taxes and the Pastor should be making quarterly SE payments on the base payment plus the housing allowance.

Would you be able to confirm if my understanding is correct and if the church should amend the 941's for 2023.