Basic Accounting Tips

Knowledge of some basic accounting concepts and bookkeeping systems is necessary in order to set up and maintain an accounting system for your church or nonprofit.

Coupon!

Here is a 10% discount code for all the ebooks, spreadsheets, and packages on this site:

FCA

Note: click on "PACKAGES" in the top navigation bar for a list of all of the ebook and spreadsheet packages on this site!

There are basically two bookkeeping practices:

- Single entry bookkeeping can be employed by small churches or nonprofits where a balance sheet is not required for financial control or tax purposes.

- Double entry bookkeeping is required for all organizations that must produce both a Statement of Activity and a Statement of Financial Position (Balance Sheet). See more on financial statements for nonprofits.

To really understand the difference between these two bookkeeping systems, you must understand some basic accounting concepts.

Bookkeeping for Churches Package

A set of 4 ebook that covers the following topics...

- Fund accounting examples and explanations

- Best methods for tracking restrictive funds

- Basic accounting concepts

- Examples and explanations of financial statements

- Chart of Account breakdown

- How to record income, expenses, payroll, etc.

- Much more - Click here for details

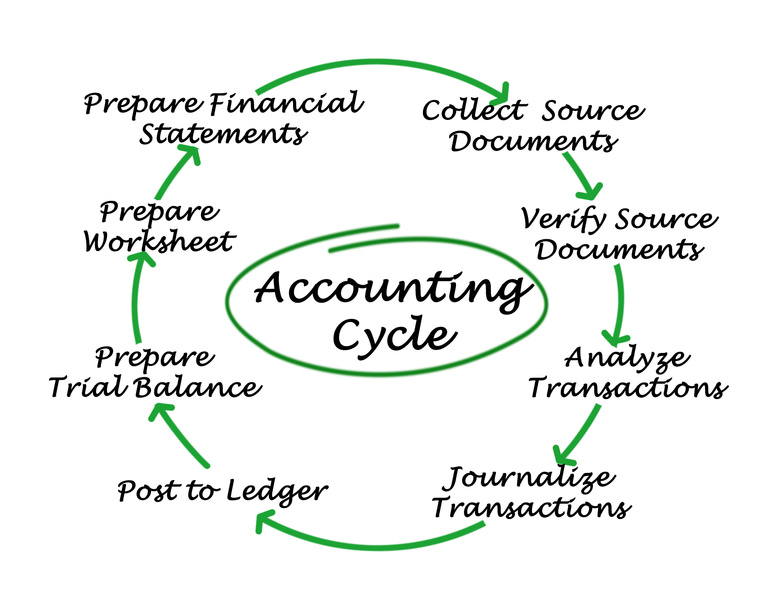

Two Basic Accounting Concepts:

1. The Basic Accounting Equation:

Assets = Liabilities + Net Assets.

(A nonprofit organization does not have owners, so the third part of the above equation is known as net assets instead of owner's equity or stockholders' equity.)

2. Debit = Credit

Let’s discuss the second one first. In basic paper accounting, accounts are set up to look like a “T” and are actually called T accounts –very imaginative huh?

Anyway...in this “T” account – amounts entered on the debit side (left hand side) are called debits and amounts on the credit side (right-hand side) are called credits.

'To debit' means to make an entity in the left-hand side of an account' and 'To credit' means to make an entry in the right-hand side of an account.

Donation Guidelines Package

A set of 4 ebook packages that covers many of the following topics...

- How to handle and receipt stock donations

- How to handle free rent and labor donations

- How to handle non-cash contributions

- What to do if you receive a DAF (donor advised fund) contribution or grant

- How to handle Quid Pro Quo donations and other fundraising income such as drawings and raffles

- Donation policies and procedures

- Much more - Click here for details

Important! The words debit and credit have no other meaning in accounting. Most people think a debit and credit as a positive or a negative. They are not either.

Now...back to rule number 2...Debits and credits must be equal for all entries in a double entry bookkeeping system.

A debit or credit will either increase or decrease an account balance depending on what type of account you are working with.

Now to the first basic accounting concept:

Assets = Liabilities + Net Assets

or

Net Assets = Assets -Liabilities

What this really means is that, from an accounting perspective, the Net Assets (also known as Net Worth, Retained Earnings, or Fund Balance) is the difference between what your organization owns (Assets) and what your organization owes (Liabilities).

Learning those two basic concepts was not too hard was it?

Ummm...well...let’s move on to something easier...

The Policies and Procedures Package includes an ebook on Receipts and Reimbursements that explores the management of receipts and supporting documents.

Additionally, it provides insights on establishing and managing an efficient accountable reimbursement policy.

Includes a sample of a resolution you can use to present to the board to set up and approve an accountable reimbursement plan.

.

This ebook is included in the Policies and Procedures Package. However, you can purchase it by itself for only $7.95 by clicking the ADD TO CART button below!

The Receipts and Reimbursements ebook is also part of a larger "Policies and Procedures" Package" that is packed full of valuable information and for a limited time you can purchase all 5 ebooks and 8 policy templates for only $32.80

Single Entry Bookkeeping:

There are advantages and disadvantages of using a single entry bookkeeping system.

The main advantage is the simplicity. It involves the simplest form of keeping records of financial transactions.

Essentially the organization makes two lists, one of income received and one of expenses incurred.

This is beneficial for organizations that rely on volunteers with virtually zero accounting or bookkeeping knowledge. It is similar to a check register.

You add your increases and take away your expenses...all the while keeping a running daily balance.

The main disadvantage of single entry bookkeeping is the absence of financial control due to limited detailed records of asset and liability accounts.

It is also easier to make errors with. With double entry bookkeeping everything must balance.

Managing bookkeeping for churches can present unique challenges. Apart from standard accounting procedures, there is the additional task of managing restricted funds alongside the overall financial records.

You might be facing a chart of accounts overloaded with numerous unnecessary accounts from past volunteers. On top of that, you've come across errors in your payroll entries. These ebooks on church bookkeeping are specifically designed to assist you in handling these issues effectively.

Description page for the ebooks and bonuses included in the Bookkeeping for Churches Package

Double Entry Bookkeeping:

Most medium and large organizations use a double entry system which tracks their income (donations) and expense AND their assets and liabilities.

Double entry bookkeeping is require for all organizations that are required to produce a statement of its assets and liabilities (a Balance Sheet or Statement of Financial Position).

In a double entry bookkeeping system, at least two entries are made with every financial transaction recorded...a debit and credit.Each transaction must balance each other. For every increase in one account, there is an opposite (and equal) decrease in another.

Double entry bookkeeping computerized systems have come a long

way in the ease of using them. Most of the time you just have one entry

to make and the program does the additional entries required to balance

your transaction.

To learn more basic church and nonprofit accounting purchase my Bookkeeping for Churches Package.

It provides you with fund accounting concepts; examples of accounting

journal entries; descriptions and examples of financial statements; a

chart of accounts for a church; a chart showing what accounts you debit

and what you credit; and step-by-step instructions for posting church

business transactions.

Learn some basic accounting definitions

Basic Accounting Free Spreadsheets:

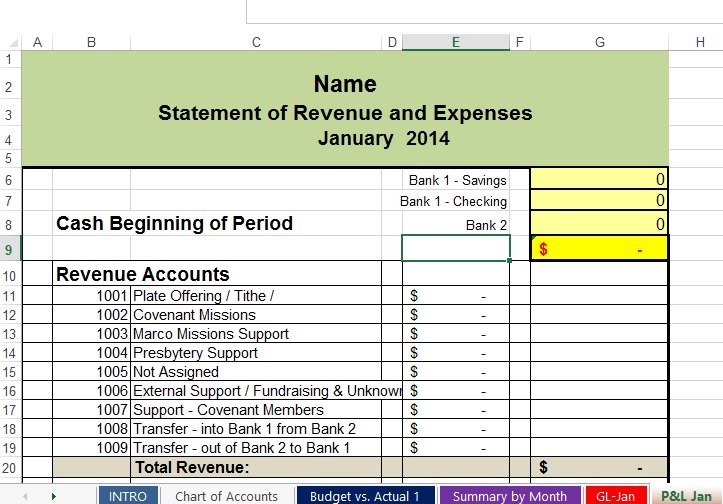

I have built my accounting spreadsheets using the single entry bookkeeping system outlined above.

They are pretty simple to use, but be aware that because they are a single entry bookkeeping system, they cannot track your assets and liabilities and cannot generate a balance sheet. A Balance Sheet has to be created separately. There are tons of templates for Balance Sheets on the internet.

Free Basic Accounting Spreadsheets

Coupon!

Here is a 10% discount code for all the ebooks, spreadsheets, and packages on this site:

FCA

Note: click on "PACKAGES" in the top navigation bar for a list of all of the ebook and spreadsheet packages on this site!