Accounting for In-Kind Donations

How to Acknowledge and Record those Types of Donations

Sometimes churches and nonprofits receive in-kind donations. Gifts in-kind are donations of items, use of property, and professional services. Accounting for those type of donations can oftentimes be confusing. See how to acknowledge and account for those donated goods and services...

What are In-Kind Donations?

In-kind donations are basically gifts of tangible and intangible personal property and donations of services.

There are typically three categories of in-kind donations. They are

- contributions of tangible and intangible goods

- use of property

- donations of services

Some examples of tangible gifts in-kind (physical goods that can be touched or held) include:

- furniture donation

- equipment donation

- food donation

- clothing donation

- inventory, and supplies

Some examples of intangible gifts in-kind (goods have value but do not have a physical presence) include:

- trademarks

- copyrights

- patents

- royalties

- advertising

Examples of use of property include:

- leased space

- discounted rent

Gifts in-kind can include professional services rendered by:

- accountants and bookkeepers

- lawyers

- plumbers

- electricians

- nurses and physicians

- Computer programmer, designers, technical support, etc.

- Contractors

Now that we have established what a in-kind donation is, let's move on to "how and when" to record those donations!

Church Accounting Package

A set of 4 ebooks that covers the following topics...

- Fund Accounting Examples and Explanations

- Setting up a fund accounting system

- Donation management

- Minister compensation and taxes

- Internal controls and staff reimbursements

- Much more - Click here for details

Donation Valuation

Let me start out with saying EVERY nonprofit organization and church should have a written policy outlining their guidelines for accepting or NOT accepting in-kind donations. The rule of thumb usually is...if it cannot be used or sold, do not accept it.

As far as whether or not to record those gifts in your accounting records, a good rule of thumb is ...if it has value and would have been purchased by the nonprofit organization if not donated...it's a good idea to record the in-kind contribution.

For example, a donor donates a couple of computers and printers that the church will be using in the office. You can record the value in your fixed assets.

Your donation valuation method will depend on the in-kind gift. Since some of those valuation methods can get really detailed, I will give you a brief overview and provide links to more detailed articles regarding in-kind donation valuation below.

Donated goods received in bulk from retailers and manufacturers such as a grocery store donating canned goods to your food bank or a retail store donating backpacks to your outreach program...are usually the easiest to value as you can just use the wholesale value of the items.

Use of property donations such as reduced or free rent should be recorded and measured at fair market value.

Donated services are only recorded if:

- the service requires specialized skills such as a lawyer, accountant, electrician, etc,

- the service would have had to been purchased if not donated

Note: even though these specialized services can and should be recorded in your accounting, the IRS does not allow tax deductions for donated services, so a contribution receipt would not be issued (more on that below).

(Links to more detailed gift in-kind donation valuation methods are listed at the bottom of this article.)

How to Record In-Kind Gifts

How you record the in-kind contribution in your accounting records will depend on your accounting software. In most accounting systems, you will record the gift in-kind as a journal entry. However, you will need to first set up some new accounts in your chart of accounts...such as:

- In-Kind Contributions (income)

- Professional Service In-Kind (expense)

- Supplies (expense)

- Equipment In-Kind (expense...if donation NOT considered a capitalized asset)

- Assets In-Kind (fixed asset)

If you use QuickBooks:

Lisa London's book "Using QuickBooks Online" explains how to set up and record in-kind donations with journal entries and gives step by step examples. Let me stop here and encourage EVERY church or nonprofit that use or plan on using QuickBooks Online (QBO) to purchase Lisa's book and keep it beside your computer! It has hundreds of screen shots and step by step instructions on pretty well everything you need to do to make QuickBooks work efficiently for you. If you have the desktop QuickBooks version, see her QuickBooks for Churches.

If you use Aplos:

See Alex's great examples of journal entries for recording donated items.

Some in-kind contribution journal entry examples...

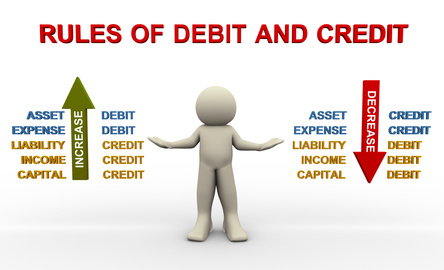

An accountant donates 5 hours a month to do some accounting work that your organization would have had to pay another accountant to do. She regularly charges $100 per hour to do a similar service. To record this gift in-kind you would:

- Debit Professional Service In-Kind $500

- Credit In-Kind Contributions $500

Another example:

A business donates a portable building valued at $12,000. Assuming that your organization has a policy to capitalize assets of this value, you would record this gift in-kind like this:

- Debit the fixed asset account (Portable Building In-Kind) $12,000

- Credit the In-Kind Contributions $12,000

Another business donates an air conditioner valued at $800. Assuming that your organization has a policy to expense assets of this value, you would:

- Debit the Equipment In-Kind (expense account) $800

- Credit the In-Kind Contributions $800

More examples of in-kind donation journal entries are in the article list at the bottom of this page.

How to Acknowledge In-Kind Donations

In addition to recording the gifts in-kind in your accounting systems, it is appropriate to acknowledge the non cash contribution by generating a donor receipt. Unlike the recording of those donations, you should NOT (in most cases) include a value on a non cash contribution receipt. See an example of a non cash contribution receipt.

The exceptions to this rule include donations of vehicles, boats, and planes. The rules regarding those donations and donations valued at $500 plus can be found on the IRS's site. My ebook Handling Donations details how to handle and acknowledge those donations along with other uncommon contributions.

Note: the IRS does NOT allow charities to issue charitable contribution receipts for donated services! Donated services such as the accountant work discussed above is not a tax deductible contribution for the donor (Rev. Rul. 162, 1953-2 C.B. 127).

Also...you cannot issue a contribution receipt for discounted or free rent as the IRS has determined that rent free use of real or personal property does not represent a “payment” under IRC 170(a)(1)(Rev. Rul. 70-477, 1970-2 C.B. 62). BUT if the donor donated all or part of real property and transferred the title to the nonprofit, you could issue a noncash contribution receipt =)