Form 990-N Requirement

Form 990-N is a short electronic return for nonprofit organizations whose annual receipts are normally $50,000 or less.

You will need 8 pieces of information to file a 990-N also known as the e-Postcard. See what they are and if you are required to file this form below...

Are you required to file an annual Form 990-N?

Section 6033 of the tax code requires most nonprofit organizations to file an annual return (Form 990) with the IRS.

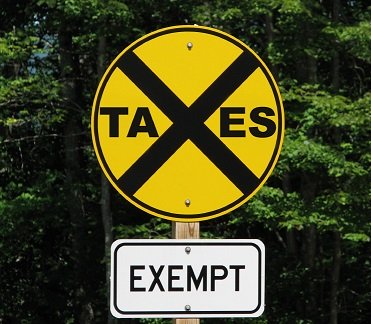

However, there are some nonprofit organizations that are exempt from this filing requirements, they include:

- churches

- religious orders,

- certain foreign missionary organizations

Important: Even though churches are exempt from filing Form 990, they are not exempt from filing a Form 990T...if they have unrelated business income!

Note: Ministries are required to file a 990. If you have filed for tax exempt recognition from the IRS with a 1023 form and been approved, check your 501(c)(3) letter and see what the IRS classified you. See how to find out this information on this page: Tax Exempt Status

Organizations recognized as exempt from Federal income tax that does not fall under the above exempt categories -- generally must file an annual information return (Form 990, 990-EZ or 990-N) -- if it has averaged more than $50,000 in gross receipts over the past three tax years.

Small nonprofit organizations with an average gross income under $50,000 do not have to file one of the extensive 990 forms, but they are required by law to file an annual 990-N (e-Postcard). More on that form later.

If your organization has gross annual receipts that average more than $50,000, but less than $200,000 and less than $500,000 in total assets, you are generally eligible to file a Form 990-EZ ... which is still a formidable form. That form can be up to 28 pages with required schedules you may (or may not) need and in-depth financials.

All other nonprofit organizations with more than $200,000 and or $500,000 (total assets) are generally required to file the 990 form. As with everything else with the IRS, there are always exceptions to the rules, so if in doubt which form your organization is required to file, consult a knowledgeable tax professional.

In fact, if you are required to file the 990 or 990-EZ period, I recommend getting professional help as the penalties for incorrect or incomplete forms can be quite steep.

How do you determine your average annual receipts?

To figure which 990 form you are required to file, you have to find the average of the last 3 years.

For example, say your organization’s gross receipts were $49,000 in 2016, $55,000 in 2017, and $47,000 in 2018.

The total of your gross receipts for those years is $151,000. The average over the three years figures to be $50,333 per year.

So, for 2018, your organization would have to file a Form 990-EZ, because the average of the gross receipts for that year plus the previous two years is greater than $50,000.

Information Required to File Form 990-N

As I stated before, if you are required to file a 990 or 990-EZ, you may want to seek professional help; however...

if you just need to file a form 990-N (e-Postcard), it is not too difficult.

In fact there is wonderful software such as Aplos that lets you file a 990-N FREE. See their site for more information: Aplos e-File

Aplos is one of the trusted partners of the IRS that offers e-filing of the Form 990-N (e-Postcard) FREE for the current year. It only takes 5 minutes and is virtually effortless.

You just need to have 8 pieces of information handy when you prepare to file it. They include:

- Employer identification number (EIN), also known as a Taxpayer Identification Number (TIN)

- Tax year

- Legal name and mailing address

- Any other names the organization uses

- Name and address of a principal officer

- Web site address if the organization has one

- Confirmation that the organization’s annual gross receipts are $50,000 or less

- If applicable, a statement that the organization has terminated or is terminating (going out of business)

Form 990-N Due Date

The deadline for submitting Form 990-N is the 15th of the fifth month after the close of the organization's tax year. If your calendar year run from January to December, you are required to submit your 990-N on or before May 15.

If the due date falls on a Saturday, Sunday, or legal holiday, the due date is the next business day.